Udyam Registration

Contact Us

Udyam Registration: Empower Your Business! 🚀

Udyam Registration is a government initiative that provides small and medium enterprises (SMEs) in India with a unique identity. This registration helps businesses access various benefits and support schemes, making it an essential step for entrepreneurs looking to grow.

At Startup2MSME, we simplify the Udyam registration process, offering a seamless online service tailored to your needs. Whether you're a new startup or an existing small business, our expert team is here to guide you every step of the way.

Contact us today to begin your Udyam registration journey! 📞

What is Udyam Registration? 📝

Udyam Registration is a process that provides a unique Udyam registration number to small and medium-sized enterprises. This registration helps in the recognition of your business as an MSME (Micro, Small, and Medium Enterprise) under the Ministry of Micro, Small and Medium Enterprises. It unlocks access to various government schemes, subsidies, and incentives designed to support business growth.

Importance of Udyam Registration 🎯

• Legal Recognition: Establishes your business as an official MSME, allowing you to avail benefits and schemes offered by the government.

• Access to Financial Aid: Registered businesses can access loans with lower interest rates, grants, and subsidies from various financial institutions.

• Market Opportunities: Gain eligibility for government tenders and contracts that prioritize MSMEs.

• Tax Benefits: Registered MSMEs may receive tax exemptions and other incentives under various government policies.

• Skill Development: Access to skill development programs funded by the government to enhance your workforce.

Eligibility Criteria for Udyam Registration 📌

To register for Udyam, you need to meet the following criteria:

• Investment Limits:

o Micro Enterprises: Investment up to ₹1 crore.

o Small Enterprises: Investment between ₹1 crore and ₹10 crores.

o Medium Enterprises: Investment between ₹10 crores and ₹50 crores.

• Turnover Limits:

o Micro Enterprises: Turnover up to ₹5 crores.

o Small Enterprises: Turnover between ₹5 crores and ₹50 crores.

o Medium Enterprises: Turnover between ₹50 crores and ₹250 crores.

Required Documents for Udyam Registration 📄

To complete your Udyam registration, you need to prepare the following documents:

• Aadhaar Number: For individuals or proprietors, the Aadhaar number is essential.

• PAN Card: Permanent Account Number of the business entity.

• Business Registration Proof: Any registration document, such as GST registration or a company incorporation certificate.

• Investment Details: Information regarding the investment in plant and machinery (for manufacturing) or equipment (for services).

• Turnover Details: A declaration of your business turnover for the previous financial year.

Udyam Registration Process 🛠️

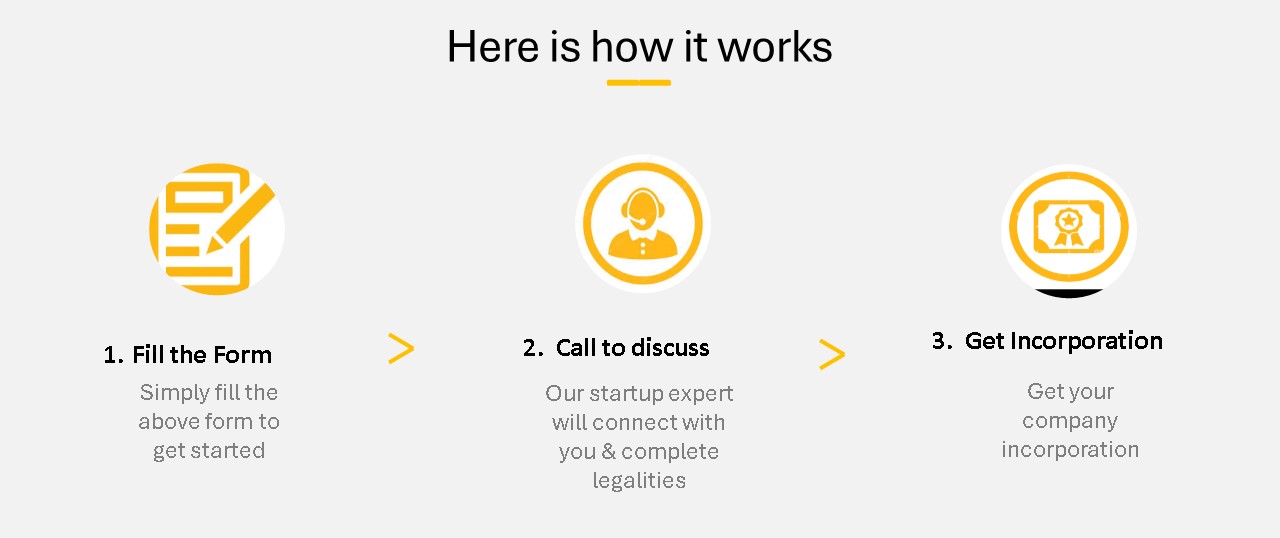

Follow these simple steps to register for Udyam:

1. Visit the Udyam Registration Portal: Access the official Udyam registration website.

2. Provide Aadhaar Number: Enter the Aadhaar number of the applicant.

3. Enter Business Details: Fill in details about your business, including the type of enterprise, investment, and turnover.

4. Upload Documents: Attach the necessary documents for verification.

5. Submit the Application: Review all information and submit your registration application.

6. Receive Udyam Certificate: Once verified, you will receive an Udyam registration certificate with a unique number, confirming your MSME status.

How Can Startup2MSME Help? 💼

We make Udyam registration effortless! At Startup2MSME, our dedicated team provides expert guidance, assists with document preparation, and ensures compliance with all requirements—offering our services at competitive prices. We handle your application submission and keep you informed throughout the process. Whether you’re starting a new venture or formalizing an existing business, our tailored services will meet your unique needs. With Startup2MSME, you can confidently navigate the Udyam registration process and unlock the benefits designed to fuel your business growth. Contact us today to get started on your Udyam registration! ✨

Our Clients

Services

FAQ

1. Who is eligible for Udyam (Udyog Aadhar) registration?

Any individual or entity looking to start a micro, small, or medium enterprise (MSME) can apply for Udyam registration. The eligible entities include:

Partnership firms, One Person Companies (OPCs), Proprietorships, Private Limited Companies, Limited Companies, Producer Companies, Limited Liability Partnerships (LLPs), Co-operative societies, Hindu Undivided Families (HUF), Any association of persons or other undertakings

Note: As per the revised guidelines, retail and wholesale businesses can also register on the Udyam Registration Portal.

2. Are there any fees for Udyam registration?

No, Udyam registration for MSMEs is completely free of charge. The process is entirely online and paperless, with no fees involved at any stage. Startup2msme can assist with the registration process to ensure it is quick and hassle-free.

3. What are the benefits of Udyam Registration?

Udyam registration offers several advantages to MSMEs:

• Permanent and primary identification number for the enterprise

• Paperless, self-declaration-based registration

• No need for renewal; registration is valid permanently.

• Suitable for both manufacturing and service activities in a single registration

• MSMEs can join the TReDS platform

• Access to various schemes, such as: Credit Guarantee Scheme, Public Procurement Policy, Priority sector lending from banks, Protection against delayed payments and competitive edge in government tenders

4. What is the NIC code in Udyam registration?

The NIC code (National Industrial Classification code) is a government-assigned business code that helps track and classify the activities of an MSME. It is required for Udyam registration.

5. How many NIC codes can be added during Udyam registration?

A maximum of 10 NIC codes can be included in a single Udyam registration to represent various business activities.

6. What is Udyam registration?

Udyam registration is the latest process introduced by the government on July 1, 2020, for registering MSMEs. It replaces the previous Udyog Aadhar system and simplifies the process, allowing MSMEs to easily obtain their Udyam certificate.

7. Who is eligible for Udyam registration?

Anyone intending to establish a micro, small, or medium enterprise can apply online for Udyam registration and obtain a Udyam certificate.

8. Who can apply for MSME registration?

The following entities, based on their annual turnover and investment as per the revised MSME classification, are eligible for MSME registration: Individuals, startups, and entrepreneurs, Private and public limited companies, Sole proprietorships, Partnership firms, Limited Liability Partnerships (LLPs), Self-Help Groups (SHGs), Co-operative societies,Trusts These entities can engage in manufacturing, service enterprises, or small-scale retail and wholesale activities.

9. What are the MSME definitions effective from July 1, 2020?

The MSME classification is based on investment in plant and machinery, along with turnover:

• Micro Enterprises: Investment below ₹1 crore and turnover less than ₹5 crore.

• Small Enterprises: Investment below ₹10 crore and turnover less than ₹50 crore..

• Medium Enterprises: Investment below ₹20 crore and turnover less than ₹100 crore.

10. How can I download my Udyam registration certificate?

To download your Udyam registration certificate, log in to the Udyam Registration Portal using your credentials and download the certificate from your account dashboard.

Contact

KP SQUARE, 8th Floor, office no -: 806, 41/3, Telco Rd, Indira Nagar, Mohan Nagar, MIDC, Chinchwad, Pimpri-Chinchwad, Maharashtra 411019

Email Us

Pvt Ltd Incorporation

Pvt Ltd Incorporation

LLP Incorporation

LLP Incorporation

Trademark Registration

Trademark Registration

Udyam Registration

Udyam Registration

DSC-Digital Signature Certificate

DSC-Digital Signature Certificate

Startup India Registration

Startup India Registration

GST Registration

GST Registration

Preparation of MIS

Preparation of MIS

ESI Registration

ESI Registration