Limited Liability Partnership

Contact Us

Limited Liability Partnership (LLP) Registration: Your Path to a Secure Business Structure 🔑

A Limited Liability Partnership (LLP) is a unique business structure that combines the advantages of a traditional partnership with the benefits of limited liability. This allows partners to enjoy the flexibility of partnership while protecting their personal assets from the debts and liabilities of the business. Registering your LLP is an essential step toward establishing a legally recognized business entity.

At Startup2MSME, we understand that the LLP registration process can be complex. That’s why we offer a smooth and hassle-free online service for LLP registration, designed to meet your needs with competitive fees. Whether you're starting a new venture or formalizing an existing partnership, our expert team is here to guide you every step of the way.

Contact us today to begin your Limited Liability Partnership registration journey! 📞

What is an LLP? 🤝

An LLP is a hybrid business structure that offers the flexibility of a partnership with the limited liability features of a corporation. In an LLP, partners are not personally liable for the negligence or misconduct of other partners, providing a safety net for individual assets. This structure is particularly popular among professional service providers like lawyers, accountants, and consultants.

Legal Framework for LLP Registration 📜

In India, LLPs are governed by the Limited Liability Partnership Act, 2008. This legislation provides a robust framework for LLP operations, including the rights and responsibilities of partners and the registration process.

Benefits of LLP Registration 🌟

• Limited Liability: Partners’ personal assets are protected from the LLP's debts and obligations, reducing financial risk.

• Flexibility in Management: LLPs allow for flexible management structures, enabling partners to define their roles and responsibilities.

• Separate Legal Entity: An LLP is a distinct legal entity, which enhances credibility and allows it to enter into contracts in its name.

• Tax Benefits: LLPs enjoy pass-through taxation, meaning profits are taxed at the individual partner level rather than at the company level, potentially reducing overall tax liability.

• Minimal Compliance Requirements: LLPs have fewer compliance obligations compared to traditional companies, making them easier to manage.

• Increased Credibility: Registering as an LLP enhances the business's reputation, helping to attract clients and investors.

Partnership Firm Registration 🏢

Registering a partnership firm involves officially registering it with the Registrar of Firms in the state where the firm operates. While registration is optional, it offers numerous advantages. Partners can choose to register the partnership deed during the firm’s formation or at a later stage.

To register the partnership deed, two or more individuals must come together, agree on a firm name, and create the deed.

Who Can Form an LLP? ✅

To register an LLP in India, the following conditions must be met:

• Minimum Partners: An LLP must have at least two partners, and there is no limit on the maximum number of partners.

• Designated Partners: At least two designated partners must be individuals, and at least one must be a resident of India.

• Legal Competence: All partners must be legally competent to contract, which means they must be of legal age and mentally sound.

Documents Required for LLP Registration 📄

To register your LLP, you will need the following documents:

• Identity Proof: PAN card or passport of all partners.

• Address Proof: Utility bills, bank statements, or rental agreements of the registered office.

• Digital Signature: A Digital Signature Certificate (DSC) for all designated partners.

• Consent from Designated Partners: A consent letter from all partners agreeing to the formation of the LLP.

LLP Registration Process 🛠️

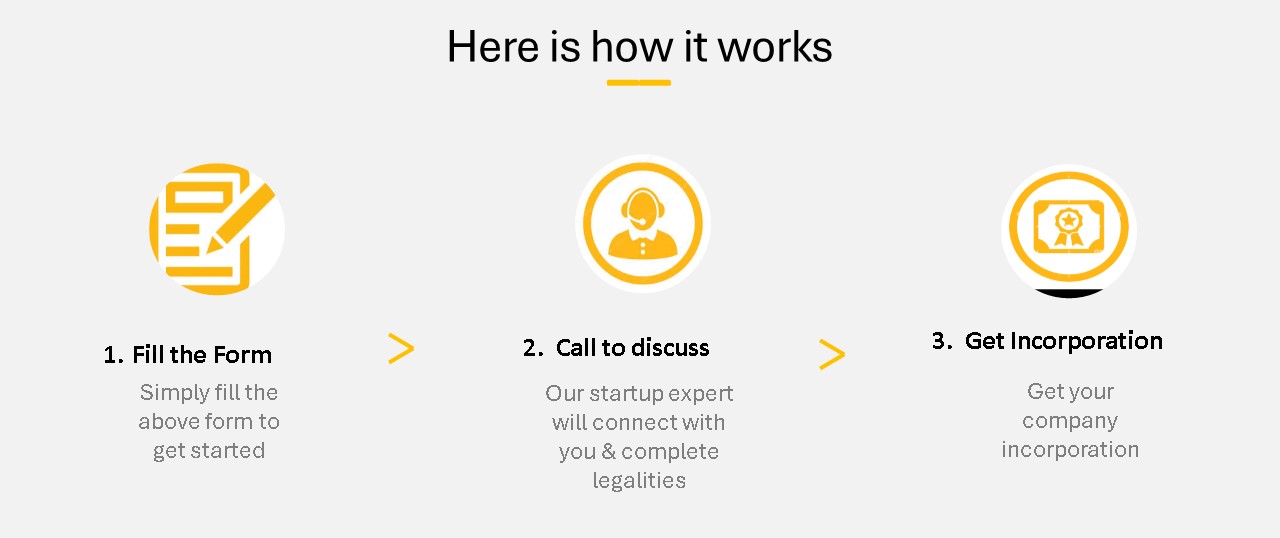

Here’s a step-by-step guide to registering your Limited Liability Partnership:

1. Obtain a Digital Signature Certificate (DSC): All designated partners must acquire a DSC for online document signing, available from certified agencies.

2. Apply for a Designated Partner Identification Number (DPIN): Each designated partner must apply for a unique DPIN through the Ministry of Corporate Affairs (MCA) website.

3. Choose a Name for the LLP: Select a unique name that complies with legal naming regulations and is not similar to existing companies.

4. Draft the LLP Agreement: Prepare a comprehensive LLP agreement that outlines the rights and duties of partners, profit-sharing ratios, and the LLP's operational guidelines.

5. File the Registration Application: Submit the application to the Registrar of Companies (RoC) along with the necessary documents.

6. Obtain the Certificate of Incorporation: After verification, the RoC will issue a Certificate of Incorporation, confirming the registration of your LLP.

7. Apply for PAN and TAN: Finally, apply for a Permanent Account Number (PAN) and a Tax Deduction and Collection Account Number (TAN) from the Income Tax Department.

How Can Startup2MSME Help? 💼

We simplify the LLP registration process for you! Our dedicated team at Startup2MSME provides expert guidance, document preparation, name selection assistance, and ensures full compliance with all legal requirements—all at competitive fees. We handle your application submission and keep you updated throughout the process. Whether you're starting a new LLP or formalizing an existing partnership, our services are customized to meet your unique needs. Our support doesn’t stop at registration; we also help you understand your ongoing compliance responsibilities. With Startup2MSME, you can confidently navigate the LLP registration process, allowing you to focus on growing your business. Our effective solutions and affordable fees make the entire process hassle-free. Contact us today to take the first step toward establishing your Limited Liability Partnership! ✨

Our Clients

Services

FAQ

1. Who is eligible to become a partner in an LLP?s

To form an LLP, at least two designated partners are required, who must be 18 years or older and possess a valid Indian address. Partners can be individuals or corporate bodies, and foreign nationals or foreign corporate bodies can also be appointed as designated partners.

2. What is the cost of registering an LLP in India?s

The cost of registering an LLP varies based on the number of partners, the capital contribution of each partner, and registration fees. Additional costs may include professional fees, stamp duty, and other regulatory charges.

3. Is GST registration mandatory for LLPs?s

Yes, GST registration is required for LLPs, depending on the type of goods or services they provide. Once registered, LLPs must file GST returns regularly as per the Goods and Services Tax regulations.

4. How can I register an LLP in India?s

The LLP registration process is entirely online. You need to submit the required documents, and consultants or legal professionals will follow up to complete the process.

5. What is a DPIN (Designated Partner Identification Number)?s

A DPIN is a unique identification number assigned to individuals who are or will become designated partners in an LLP. It is mandatory for all designated partners to have a DPIN.

6. How long does it take to incorporate an LLP?s

The process of incorporating an LLP generally takes 14 to 20 days, depending on the submission of necessary documents and government approvals.

7. Can NRIs or Foreign Nationals be designated partners in an LLP?s

Yes, NRIs and foreign nationals can be designated partners in an LLP, provided they obtain a DPIN. However, at least one designated partner must be a resident of India.

8. Is Foreign Direct Investment (FDI) allowed in LLPs?s

Yes, LLPs are allowed to receive Foreign Direct Investment (FDI) under the automatic route. However, Foreign Institutional Investors and Foreign Capital Investors are not permitted to invest in LLPs.

9. Can a Partnership Firm be converted into an LLP?s

Yes, an existing partnership firm or unlisted company can be converted into an LLP, offering benefits such as limited liability and more flexible management structures.

10. What documents are needed to incorporate an LLP?

Documents required for LLP incorporation include:

• PAN card or Passport of partners.

• Identity proof and bank statements of partners.

• No Objection Certificate (NOC) from the landlord, if applicable. Download NOC letter from Free download section.

• Utility bills (not older than two months) for the office premises.

Additionally, you may visit www.startup2msme.in for other clarification.

Contact

KP SQUARE, 8th Floor, office no -: 806, 41/3, Telco Rd, Indira Nagar, Mohan Nagar, MIDC, Chinchwad, Pimpri-Chinchwad, Maharashtra 411019

Email Us

Pvt Ltd Incorporation

Pvt Ltd Incorporation

LLP Incorporation

LLP Incorporation

Trademark Registration

Trademark Registration

Udyam Registration

Udyam Registration

DSC-Digital Signature Certificate

DSC-Digital Signature Certificate

Startup India Registration

Startup India Registration

GST Registration

GST Registration

Preparation of MIS

Preparation of MIS

ESI Registration

ESI Registration