TDS Filing

Contact Us

TDS Return Filing: Stay Compliant with Tax Deductions! 💼

TDS (Tax Deducted at Source) Return Filing is the process of submitting your TDS returns to the Income Tax Department in India. It's a crucial compliance requirement for businesses and individuals who deduct tax at the source while making payments. Filing TDS returns ensures that the tax deducted is correctly reported and remitted to the government.

At Startup2MSME, we understand that navigating the registration procesAt Startup2MSME, we make TDS return filing hassle-free and efficient, guiding you through every step of the process to ensure compliance with all regulations. Whether you’re a business owner or an individual responsible for TDS deductions, our expert team is here to assist you!

Contact us today to streamline your TDS return filing! 📞

What is TDS? 📊

TDS (Tax Deducted at Source) is a system of tax collection in India where a certain percentage of tax is deducted from payments made to individuals or entities. This includes payments like salaries, rent, professional fees, etc. The deducted amount is then deposited with the government.

Legal Framework for Section 8 Companies 📜

The registration and operation of Section 8 Companies are governed by the Companies Act, 2013. This legislation provides guidelines on how to establish, operate, and dissolve these companies, ensuring transparency and accountability in their activities.

Why is TDS Return Filing Important? 🔑

• Legal Requirement: Filing TDS returns is mandatory for individuals and entities who have deducted tax at source.

• Avoid Penalties: Timely filing helps avoid penalties and interest on late payments.

• Compliance: It ensures compliance with the Income Tax Act and maintains your credibility as a taxpayer.

• Claiming Credits: It allows the deductor to claim TDS credit against their tax liabilities.

Key Requirements for Section 8 Company Registration 🔍

Here’s a list of essential documents needed for the registration process:

• Identity Proof: PAN card, Aadhar card, or passport of all directors and members.

• Address Proof: Utility bills, rental agreements, or property documents for the registered office.

• MOA and AOA: Memorandum of Association (MOA) and Articles of Association (AOA) detailing the company’s objectives and rules.

• NOC from Landlord: A No Objection Certificate from the property owner where the company will be registered.

Who Needs to File TDS Returns? 📝

• Employers: Individuals or companies deducting TDS on salaries.

• Businesses: Firms that deduct TDS on payments like rent, contractor fees, etc.

• Individuals: Freelancers and professionals who have TDS deducted from their income.

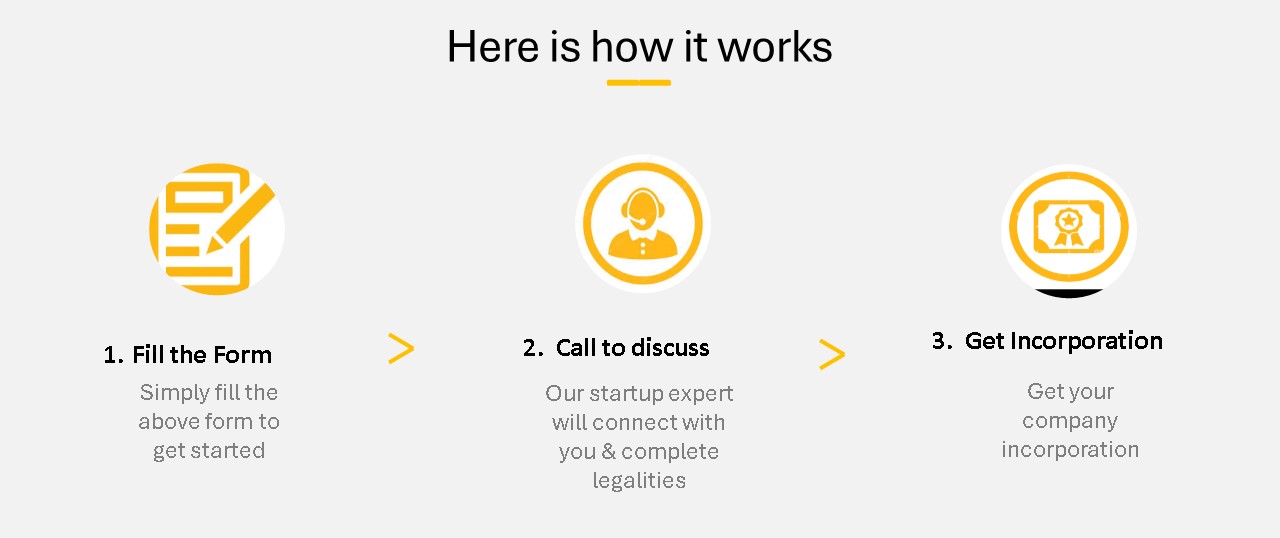

TDS Return Filing Process 🛠️

Here’s a simple step-by-step guide for TDS return filing:

1. Gather TDS Data: Collect information on all payments made during the quarter where TDS was deducted.

2. Select the Right TDS Return Form: Choose the appropriate TDS return form based on the type of deduction (Form 24Q for salaries, Form 26Q for other payments, etc.).

3. Fill Out the Form: Complete the TDS return form with accurate details of deductions, including PANs of deductees.

4. Generate TDS Challan: Pay the TDS amount through an online payment gateway and obtain a challan receipt.

5. File the Return Online: Submit the completed TDS return form on the Income Tax e-filing portal.

6. Download Acknowledgment: After successful submission, download the acknowledgment for your records.

Important Deadlines ⏳

• Quarterly TDS Returns: TDS returns must be filed quarterly, with specific due dates for each quarter (generally, the last day of the month following the quarter).

• Annual TDS Return: Certain entities may also need to file an annual TDS return.

Documents Required for TDS Return Filing 📑

To file your TDS return, gather the following documents:

• TDS Challan: Receipt of the TDS payment made to the government.

• PAN of Deductees: Permanent Account Number of all individuals/entities to whom payments were made.

• Form 16 or Form 16A: Certificate of TDS deducted (issued by the deductor) for the respective period.

• Payment Details: Information on payments made, including amounts and TDS deducted.

How Can Startup2MSME Help You? 🤝

At Startup2MSME, we simplify the TDS return filing process for you. Our expert team offers:

• Personalized Guidance: We help you gather the necessary data and select the correct forms.

• Accurate Filing: We ensure that your TDS return is filed accurately, minimizing the risk of errors.

• Timely Submission: We monitor deadlines to ensure your TDS returns are filed on time, avoiding penalties.

• Ongoing Support: After filing, we can assist with any queries related to TDS deductions or follow-up actions.

With Startup2MSME, you can confidently navigate the TDS return filing process, ensuring compliance and peace of mind while you focus on your business growth.

Contact us today to get started with your TDS return filing! ✨

Our Clients

Services

FAQ

1. What is TDS return filing?

TDS return filing involves reporting the tax deducted at the source by the deductor, aimed at minimizing tax evasion. TDS payments are made based on pre-determined rates specified under the tax laws.

2. What is the purpose of TDS?

TDS ensures tax collection at the point where income is generated. The person or entity making a payment (the deductor) is responsible for deducting the tax at source and depositing it with the central government on behalf of the recipient (the deductee).

3. On what amount is TDS deducted?

TDS is deducted only if the total income exceeds the taxable threshold. For individuals under the age of 60, no TDS is deducted if their total annual income is less than ₹2,50,000.

4. What are the consequences of not deducting TDS on time?

If TDS is not deducted or paid on time, the deductor may face penalties. Interest must be paid on late deposits, and any outstanding demand raised by the TRACES portal (TDS Reconciliation Analysis and Correction Enabling System) needs to be cleared before filing TDS returns.

5. How is TDS on salary calculated?

TDS on salary is calculated by first determining eligible exemptions under Section 10 of the Income Tax Act. These exemptions are subtracted from the gross income to arrive at the taxable salary, which is then annualized for TDS calculation based on the yearly income.

6. How long does it take to receive a TDS refund?

TDS refunds are typically processed within 30 to 45 days after the income tax return is e-verified.

7. Who is eligible to claim a TDS refund?

Employers or organizations with a valid Tax Deduction and Collection Account Number (TAN) are responsible for filing TDS returns. Individuals whose income tax deducted exceeds their actual tax liability can claim a refund when filing their returns.

8. What is the penalty for delayed TDS payment?

If TDS returns are not filed by the due date, a minimum penalty of ₹10,000 can be imposed, which may increase to a maximum of ₹1,00,000.

9. How long does it take for TDS to reflect in Form 26AS?

TDS amounts typically appear in Form 26AS within 30 to 45 days, depending on how quickly the deductor’s accounts department processes the payments.

10. Who issues the TDS certificate?

The employer issues Form 16 or Form 16A as a TDS certificate. These forms provide details of the tax deducted and deposited on behalf of the employee or taxpayer, and it’s mandatory to provide these certificates to the deductee.

Contact

KP SQUARE, 8th Floor, office no -: 806, 41/3, Telco Rd, Indira Nagar, Mohan Nagar, MIDC, Chinchwad, Pimpri-Chinchwad, Maharashtra 411019

Email Us

Pvt Ltd Incorporation

Pvt Ltd Incorporation

LLP Incorporation

LLP Incorporation

Trademark Registration

Trademark Registration

Udyam Registration

Udyam Registration

DSC-Digital Signature Certificate

DSC-Digital Signature Certificate

Startup India Registration

Startup India Registration

GST Registration

GST Registration

Preparation of MIS

Preparation of MIS

ESI Registration

ESI Registration