Section 8 Company

Contact Us

Section 8 Company Registration: Make a Positive Impact! 🌍

A Section 8 Company is a unique structure designed for non-profit organizations aiming to promote charitable activities, education, arts, culture, and social welfare. By registering as a Section 8 Company, you gain the legal recognition and credibility needed to operate effectively while working towards a noble cause.

At Startup2MSME, we understand that navigating the registration process for a Section 8 Company can be overwhelming. That’s why we offer a hassle-free, online registration service, tailored to your needs at competitive prices. Whether you’re starting a new non-profit or transitioning an existing organization, our expert team is here to guide you every step of the way.

Contact us today to kickstart your Section 8 Company registration journey! 📞

What is a Section 8 Company? 🤝

A Section 8 Company is formed under the Companies Act, 2013 in India. It is a special category of non-profit organization that operates for charitable purposes, and it is allowed to use its profits for promoting its objectives rather than distributing them to its members.

Legal Framework for Section 8 Companies 📜

The registration and operation of Section 8 Companies are governed by the Companies Act, 2013. This legislation provides guidelines on how to establish, operate, and dissolve these companies, ensuring transparency and accountability in their activities.

Benefits of Registering a Section 8 Company 🌟

• Legal Recognition: Secures formal recognition as a non-profit organization, enhancing your credibility.

• Limited Liability: Members enjoy limited liability protection, safeguarding personal assets from company debts.

• Tax Benefits: Section 8 Companies can avail themselves of various tax exemptions and deductions, encouraging donations.

• Perpetual Succession: The company can continue its existence independently of changes in membership, ensuring continuity of operations.

• Access to Funding: Registered Section 8 Companies can attract grants and donations more easily due to their recognized status.

Key Requirements for Section 8 Company Registration 🔍

Here’s a list of essential documents needed for the registration process:

• Identity Proof: PAN card, Aadhar card, or passport of all directors and members.

• Address Proof: Utility bills, rental agreements, or property documents for the registered office.

• MOA and AOA: Memorandum of Association (MOA) and Articles of Association (AOA) detailing the company’s objectives and rules.

• NOC from Landlord: A No Objection Certificate from the property owner where the company will be registered.

Documents Required for Section 8 Company Registration 📄

In India, partnership firms are governed by the Indian Partnership Act of 1932. Partners are those who unite to form a partnership, and their agreement is documented in a partnership deed.

Legal Framework for Partnership Firms 📜

To join a partnership firm in India, individuals must meet the following criteria:

• Mental and Legal Fitness: Partners must be mentally sound, of legal age, not insolvent, and not prohibited from making contracts.

• Registered Partnerships: Registered firms can partner with other businesses.

• Hindu Family Heads: Heads of Hindu Undivided Families (HUF) can become partners if they contribute their skills and labor.

• Companies as Partners: Legal entities like companies can also be partners if permitted by their objectives.

• Trustees of Specific Trusts: Trustees of private religious, family, or Hindu trusts can join as partners unless restricted by their trust rules.

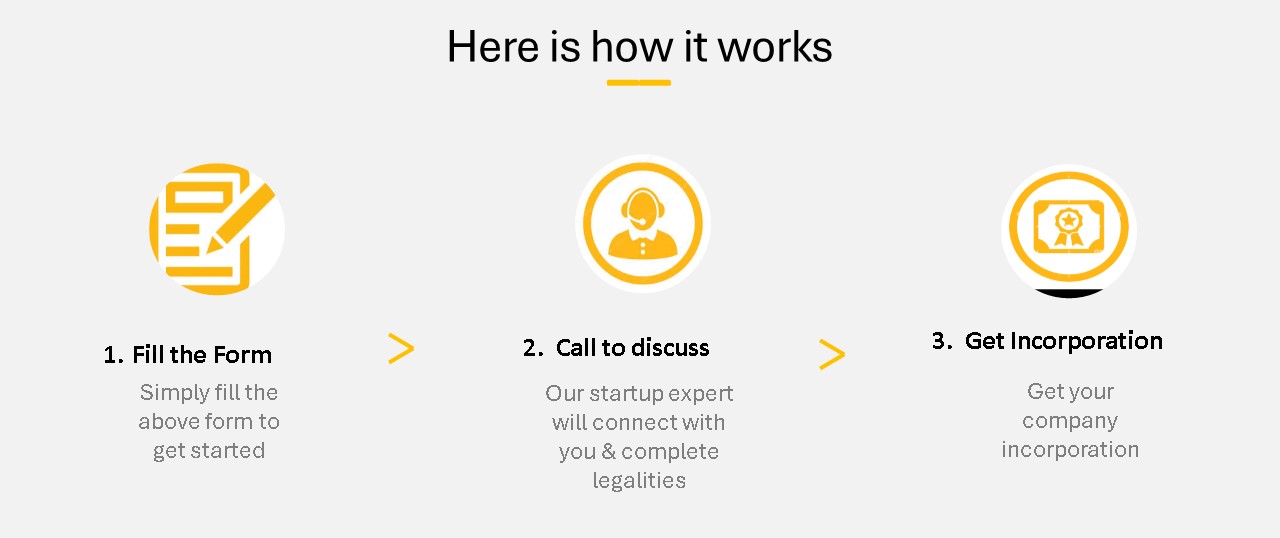

Section 8 Company Registration Process 🛠️

Follow these steps to successfully register your Section 8 Company:

1. Obtain Digital Signature Certificate (DSC): All proposed directors must obtain a DSC for online document signing.

2. Apply for Director Identification Number (DIN): Each director must apply for a DIN, which is mandatory for all directors of the company.

3. Draft MOA and AOA: Prepare the Memorandum and Articles of Association, outlining the company’s objectives and internal regulations.

4. File Form INC-12: Submit Form INC-12 with the Registrar of Companies (ROC) for obtaining a license under Section 8.

5. Verification by ROC: The ROC will verify the application and documents submitted.

6. Receive Certificate of Incorporation: Once approved, you will receive a Certificate of Incorporation, marking the formal establishment of your Section 8 Company.

7. Apply for PAN and TAN: After incorporation, apply for a Permanent Account Number (PAN) and a Tax Deduction and Collection Account Number (TAN) for tax-related matters.

How Can Startup2MSME Help? 💼

We simplify the process of registering a Section 8 Company, making it seamless and efficient for you! At Startup2MSME, our dedicated team offers expert guidance, assists in document preparation, and ensures full compliance with all legal requirements—all at competitive fees. We take care of your application submission and keep you updated throughout the process. Whether you’re establishing a new non-profit or formalizing an existing one, our services are tailored to your unique needs. Our support doesn’t end with registration; we also help you understand your ongoing responsibilities as a Section 8 Company. With Startup2MSME, you can confidently navigate the Section 8 Company registration process, allowing you to focus on making a positive impact. Our effective solutions and affordable fees make the entire process hassle-free. Contact us today to take the first step towards establishing your Section 8 Company! ✨

Our Clients

Services

FAQ

1. What is a Section 8 Company?

A Section 8 company is a not-for-profit entity established to promote areas such as arts, science, commerce, charity, education, sports, or research. These companies are formed with the intent to serve a particular cause or community, and their operations are governed by the Companies Act, 2013. Unlike other companies, their main goal is not to generate profit for members but to work towards social welfare.

2. Can a Section 8 Company generate profits?

Yes, Section 8 companies can generate profits. However, unlike traditional businesses, they are required to reinvest their profits in furthering their objectives, such as charity or social work. Their profits can come from donations, government subsidies, funding, or investments, but they cannot distribute profits to members or shareholders.

3. What is the difference between an NGO and a Section 8 Company?

An NGO (Non-Governmental Organization) is a broader term used to describe any non-profit organization working for social, educational, or charitable purposes. A Section 8 Company, on the other hand, is a specific type of NGO under Indian law, regulated by the Companies Act, 2013. While NGOs may take different legal forms, Section 8 companies are structured as formal corporate entities that can generate income but must use it for their defined purpose.

4. Do I need to be physically present to register a Section 8 Company?

No, there is no need to be physically present at any office to register a Section 8 company. The entire registration process can be handled online. You can send the required documents through email, and some may need to be couriered. The registration can be completed remotely.

5. What documents are required for the registration of a Section 8 Company?

To register a Section 8 Company, identity proof and address proof for all proposed directors are required. Indian nationals must also submit their PAN card. Additionally, if the registered office is on leased premises, a No Objection Certificate (NOC) from the landlord, along with their identity and address proof, is needed.

6. How long does it take to incorporate a Section 8 Company?

Incorporating a Section 8 Company usually takes about 20-30 days, depending on how quickly the necessary documents are submitted and the speed of government approvals. To avoid delays, it is recommended to choose a unique company name and ensure all required documents are in order before starting the process.

7. What is a Digital Signature Certificate (DSC), and why is it needed?

A Digital Signature Certificate (DSC) is an electronic form of a signature that verifies the identity of the sender or signer of a document submitted online. The Ministry of Corporate Affairs (MCA) requires that certain documents for company registration be signed using a DSC, which is mandatory for all directors of a Section 8 Company.

8. What is a Director Identification Number (DIN)?

A Director Identification Number (DIN) is a unique identification number assigned to all existing and proposed directors of a company. It is mandatory for anyone wishing to become a director in a Section 8 Company to obtain a DIN. Once issued, the DIN is valid for a lifetime and does not expire.

9. Can NRIs or foreign nationals serve as directors in a Section 8 Company?

Yes, NRIs (Non-Resident Indians) or foreign nationals can be directors in a Section 8 Company, provided they obtain a Director Identification Number (DIN). However, at least one of the directors on the board must be a resident of India.

10. Is a physical office required for a Section 8 Company?

While a dedicated office space is not compulsory, a Section 8 Company must have a registered address within India. This address serves as the company’s official location for receiving communications from the Ministry of Corporate Affairs (MCA). The address can be a residential, industrial, or commercial space.

Contact

KP SQUARE, 8th Floor, office no -: 806, 41/3, Telco Rd, Indira Nagar, Mohan Nagar, MIDC, Chinchwad, Pimpri-Chinchwad, Maharashtra 411019

Email Us

Pvt Ltd Incorporation

Pvt Ltd Incorporation

LLP Incorporation

LLP Incorporation

Trademark Registration

Trademark Registration

Udyam Registration

Udyam Registration

DSC-Digital Signature Certificate

DSC-Digital Signature Certificate

Startup India Registration

Startup India Registration

GST Registration

GST Registration

Preparation of MIS

Preparation of MIS

ESI Registration

ESI Registration