One Person Company

Contact Us

One Person Company (OPC) Registration: Simplifying Your Entrepreneurial Journey 🚀

A One Person Company (OPC) is an innovative business structure that allows a single individual to own and operate a company. This unique model provides the benefits of limited liability while allowing complete control over business decisions. Registering your OPC is a vital step toward establishing your business and ensuring its legal recognition.

At Startup2MSME, we recognize that the OPC registration process can be complex. That's why we offer a streamlined and hassle-free online service for OPC registration, tailored to fit your needs with competitive fees. Whether you’re a budding entrepreneur or an existing sole proprietor looking to formalize your operations, our expert team is ready to guide you through every step.

Contact us today to start your One Person Company registration journey! 📞

What is a One Person Company? 👤

An OPC is a type of business entity that allows a single individual to establish and manage a company while enjoying the benefits of limited liability. This means that the owner's personal assets are protected from the company’s liabilities. OPCs are ideal for solo entrepreneurs looking to create a distinct business identity without the complexities of traditional company structures.

Legal Framework for OPC Registration 📜

In India, the registration and operation of OPCs are governed by the Companies Act, 2013. An OPC can be registered with just one member, and it must designate a nominee who will take over in case of the owner's incapacity or death.

Benefits of OPC Registration 🌟

• Limited Liability Protection: The owner’s personal assets are safeguarded against the company's debts and liabilities.

• Single Ownership: Complete control over business decisions without the need for consensus from partners or shareholders.

• Easy to Manage: OPCs have fewer compliance requirements compared to other company types, making them easier to manage.

• Separate Legal Entity: The OPC is considered a separate legal entity, distinct from its owner, enhancing credibility.

• Tax Benefits: OPCs can enjoy various tax benefits and deductions, just like other corporate entities.

• Greater Access to Funding: As a registered entity, OPCs can access loans and funding more easily than unregistered businesses.

Who Can Register as an OPC? ✅

To register as a One Person Company in India, the applicant must meet the following criteria:

• Indian Citizen: The sole member must be an Indian citizen and resident in India.

• Age Requirement: The member must be at least 18 years old.

• No Non-Compliance: The individual should not be disqualified from being appointed as a director under the Companies Act.

Documents Required for OPC Registration 📄

To register your OPC, you will need the following documents:

• Identity Proof: Aadhar card, voter ID, or passport of the sole member.

• Address Proof: Utility bills, bank statements, or rental agreements of the registered office.

• Nominee’s Consent: A consent letter from the nominee along with their ID and address proof.

• Digital Signature: A Digital Signature Certificate (DSC) for the member.

OPC Registration Process 🛠️

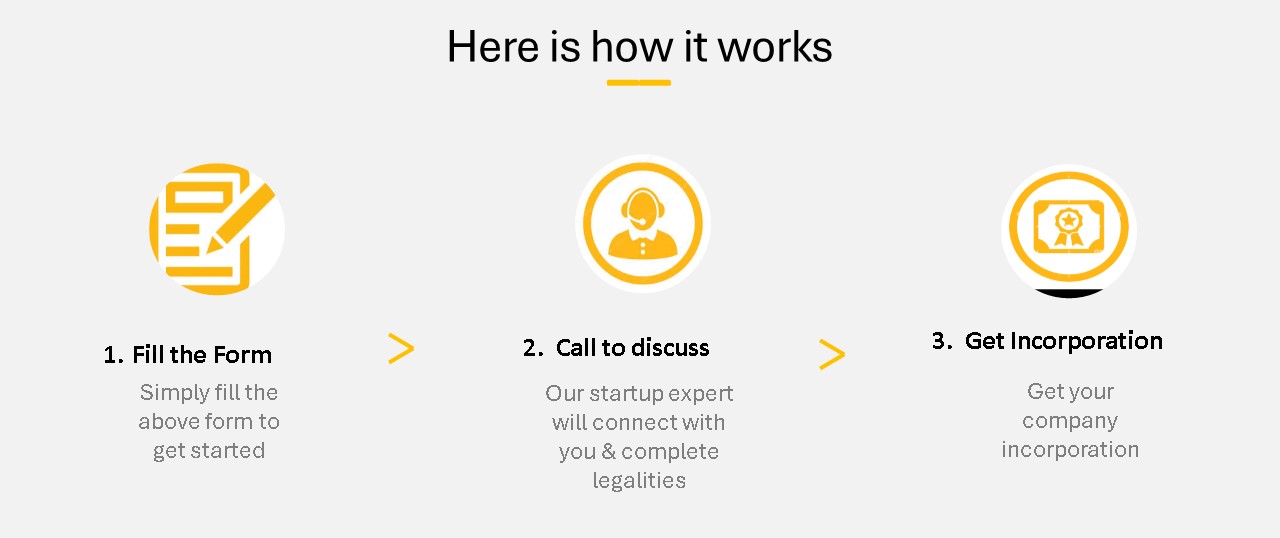

Here’s a step-by-step guide to registering your One Person Company:

1. Obtain a Digital Signature Certificate (DSC): The member must acquire a DSC for online document signing, available from certified agencies.

2. Apply for a Director Identification Number (DIN): The member must apply for a unique DIN through the Ministry of Corporate Affairs (MCA) website.

3. Choose a Name for the OPC: Select a unique name that complies with legal naming regulations and is not similar to existing companies.

4. Draft the Memorandum and Articles of Association: Prepare these documents to define the company’s objectives, rules, and regulations.

5. File the Registration Application: Submit the application to the Registrar of Companies (RoC) along with the necessary documents.

6. Obtain the Certificate of Incorporation: Upon verification, the RoC will issue a Certificate of Incorporation, confirming the registration of your OPC.

7. Apply for PAN and TAN: Finally, apply for a Permanent Account Number (PAN) and a Tax Deduction and Collection Account Number (TAN) from the Income Tax Department.

How Can Startup2MSME Help? 💼

We simplify partnership firm registration for you! Our experienced team at Startup2MSME offers expert guidance, document preparation, name selection assistance, and ensures compliance with all legal requirements—all at affordable fees. We handle your application submission and keep you updated throughout the process. Whether you're starting a new partnership or formalizing an existing one, our services are tailored to your unique needs. Our support doesn’t stop at registration; we help you understand the ongoing responsibilities of operating a registered partnership firm. With Startup2MSME, you can confidently navigate the registration process, allowing you to focus on growing your business. Our efficient solutions and reasonable fees make everything hassle-free. Contact us today to embark on your journey to a successful partnership! ✨

Our Clients

Services

FAQ

1. What is an OPC, and how does it differ from other business structures?

An OPC (One Person Company) is a business structure in India that allows a single individual to own and operate a company. It provides the flexibility of a sole proprietorship but with the limited liability protection of a private limited company.

2. When was the concept of OPC introduced in India?

The concept of an OPC was introduced under the Companies Act, 2013, to simplify the process for solo entrepreneurs to establish a company with limited liability.

3. What are the eligibility criteria for registering an OPC?

To register an OPC, the individual must be an Indian citizen and resident of India, having stayed in the country for at least 182 days in the previous financial year. The company must also have a nominee and an authorized capital of at least ₹1 lakh.

4. What are the restrictions on an OPC’s activities?

An OPC cannot engage in certain activities such as banking, insurance, or investment businesses. These sectors are reserved for other company types, like private or public limited companies.

5. What happens if an OPC’s capital exceeds ₹50 lakhs or turnover exceeds ₹2 Crores?

If an OPC’s paid-up capital exceeds ₹50 lakhs or its turnover crosses ₹2 Crores in a financial year, it must be converted into a private limited company as per the law.

6. How many OPCs can one individual form?

An individual can incorporate only one OPC at a time. They cannot be part of another OPC as a director or nominee.

7. What documents are required to register an OPC?

The documents required include:

1.PAN Card and Aadhar Card of the sole director.

2.Identity proof (passport, voter ID, or driving license).

3.Address proof (bank statement, utility bill).

4.Passport-sized photographs.

5.Registered office proof (rent agreement or ownership deed and utility bill).

5.NOC from Landlord (if rented property). NOC is attached in the free download section.

Additionally, you may visit www.startup2msme.in for other clarification.

8. What are the advantages of registering an OPC?

The key benefits include limited liability, minimal compliance requirements, simplified management, perpetual succession, and the ability to raise funds. It’s particularly suited for solo entrepreneurs who want the advantages of incorporation.

9. Are there any drawbacks to an OPC?

Yes, OPCs have limitations like restrictions on business activities, limited scalability for large ventures, and the requirement to convert to a private limited company if capital or turnover thresholds are exceeded.

10. What is the role of a nominee in an OPC?

A nominee is designated during the registration process. In the event of the OPC director’s death or incapacity, the nominee takes over the company’s operations and management.

11. What is the registration process for an OPC in India?

The process involves obtaining a Digital Signature Certificate (DSC) and Director Identification Number (DIN), reserving the company name, drafting the Memorandum of Association (MOA) and Articles of Association (AOA), filing required forms with the Registrar of Companies, and finally receiving the Certificate of Incorporation.

Contact

KP SQUARE, 8th Floor, office no -: 806, 41/3, Telco Rd, Indira Nagar, Mohan Nagar, MIDC, Chinchwad, Pimpri-Chinchwad, Maharashtra 411019

Email Us

Pvt Ltd Incorporation

Pvt Ltd Incorporation

LLP Incorporation

LLP Incorporation

Trademark Registration

Trademark Registration

Udyam Registration

Udyam Registration

DSC-Digital Signature Certificate

DSC-Digital Signature Certificate

Startup India Registration

Startup India Registration

GST Registration

GST Registration

Preparation of MIS

Preparation of MIS

ESI Registration

ESI Registration