Private Limited Company

Contact Us

What is a Private Limited Company? 🏢

A Private Limited Company (Pvt Ltd) is a type of business entity that offers limited liability to its owners (shareholders). This means that the personal assets of the shareholders are protected from the company’s debts. Private Limited Companies are popular for their flexibility, limited regulatory burden, and ability to raise capital by attracting investors.

Legal Framework for Private Limited Company Incorporation 📜

In India, Private Limited Companies are governed by the Companies Act, 2013. This legislation outlines the rules and regulations for company formation, operations, and compliance requirements.

Benefits of Incorporating a Private Limited Company 🌟

• Limited Liability: Shareholders' personal assets are shielded from the company’s debts, minimizing financial risk.

• Separate Legal Entity: A Private Limited Company is a distinct legal entity, allowing it to own assets, enter contracts, and sue or be sued in its name.

• Increased Credibility: Incorporation enhances the business’s reputation, making it more attractive to investors, partners, and customers.

• Easier Fundraising: Pvt Ltd companies can raise capital through equity financing, allowing for growth and expansion.

• Perpetual Succession: The company continues to exist even if ownership changes, providing stability for long-term business operations.

• Tax Benefits: Private Limited Companies may benefit from lower corporate tax rates and various tax incentives.

Who Can Incorporate a Private Limited Company? ✅

A partnership deed is a legal document that specifies the terms and conditions of the partnership. It outlines partners’ rights and duties, profit-sharing ratios, capital contributions, and the duration of the partnership.

This document is crucial as it helps prevent misunderstandings among partners by clearly defining their roles. It also serves as proof of the partnership’s existence and can be used in legal disputes.

Partnership Firm Registration 🏢

To register a Private Limited Company in India, the following criteria must be met:

• Minimum Shareholders: A minimum of two shareholders is required, with a maximum limit of 200.

• Directors: At least two directors are necessary, and at least one must be a resident of India.

• Legal Capacity: All directors and shareholders must be legally competent to enter into contracts.

Who Can Be a Partner? 👥

In India, partnership firms are governed by the Indian Partnership Act of 1932. Partners are those who unite to form a partnership, and their agreement is documented in a partnership deed.

Documents Required for Private Limited Company Incorporation 📄

To incorporate your Private Limited Company, you will need the following documents:

• Identity Proof: PAN card, passport, or voter ID of all shareholders and directors.

• Address Proof: Utility bills, bank statements, or rental agreements for the registered office.

• Digital Signature: A Digital Signature Certificate (DSC) for all directors for online document signing.

• Consent from Directors: A consent letter from all directors agreeing to their appointment.

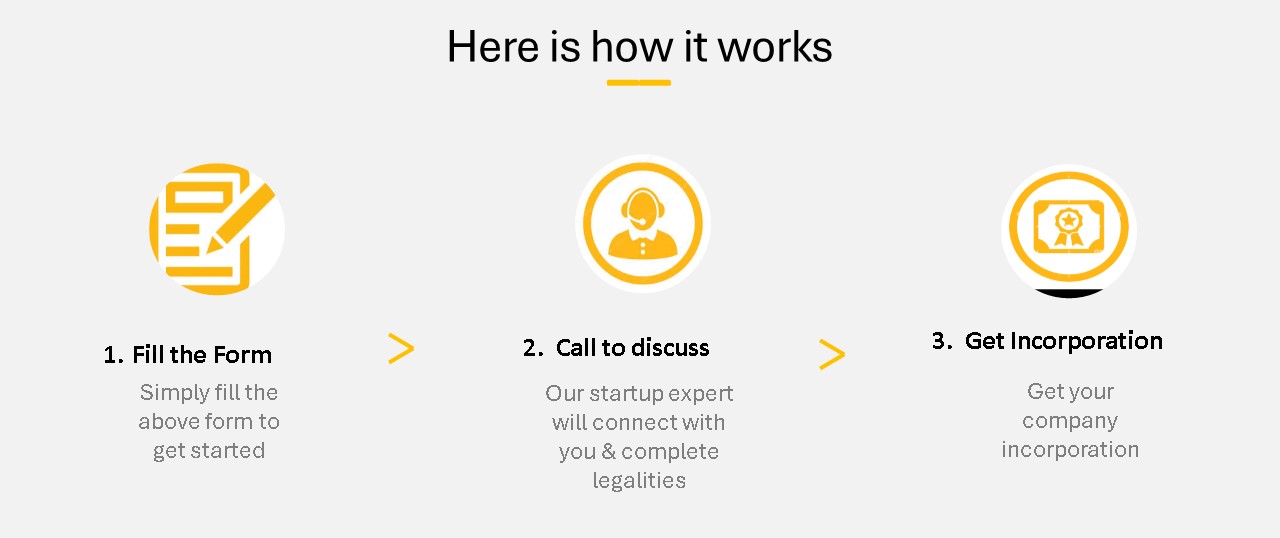

Private Limited Company Incorporation Process 🛠️

Here’s a step-by-step guide to incorporating your Private Limited Company:

1. Obtain a Digital Signature Certificate (DSC): All directors must secure a DSC for online document signing from certified agencies.

2. Apply for a Director Identification Number (DIN): Each director must apply for a unique DIN through the Ministry of Corporate Affairs (MCA) website.

3. Choose a Company Name: Select a unique name that complies with legal naming regulations and is not identical to existing companies.

4. Draft the Memorandum and Articles of Association: Prepare these key documents, outlining the company's objectives and internal rules.

5. File the Registration Application: Submit the application with the necessary documents to the Registrar of Companies (RoC).

6. Obtain the Certificate of Incorporation: After verification, the RoC will issue a Certificate of Incorporation, confirming the establishment of your Private Limited Company.

7. Apply for PAN and TAN: Finally, apply for a Permanent Account Number (PAN) and a Tax Deduction and Collection Account Number (TAN) from the Income Tax Department.

How Can Startup2MSME Help? 💼

We simplify the Private Limited Company incorporation process for you! Our dedicated team at Startup2MSME offers expert guidance, document preparation, name selection assistance, and ensures full compliance with all legal requirements—all at competitive fees. We handle your application submission and keep you informed throughout the process. Whether you're starting a new company or transitioning from a different structure, our services are tailored to meet your unique needs. Our support doesn’t end at registration; we also help you understand your ongoing compliance responsibilities. With Startup2MSME, you can confidently navigate the Private Limited Company registration process, allowing you to focus on growing your business. Our effective solutions and affordable fees make the entire process hassle-free. Contact us today to take the first step toward establishing your Private Limited Company! ✨

Our Clients

Services

FAQ

1. How can I check the availability of a company name in India?

You can check the availability of your desired company name by using the Startup2Msmes company name availability search tool. This tool helps you search for names already registered in India, ensuring your chosen name is unique and complies with the guidelines of the Ministry of Corporate Affairs (MCA). The name should not be identical or too similar to existing company names or trademarks.

2. Is GST registration required when starting a Private Limited Company?

Yes, GST registration is mandatory for certain businesses. If your company is involved in interstate trading or e-commerce, or if the annual turnover exceeds ₹40 Lakhs, you are required to obtain GST registration. This process takes around 3-5 working days through Startup2Msmes. Once registered, your company must regularly file GST returns, ensuring compliance with tax regulations.

3. What are the key compliance requirements for a Private Limited Company?

A Private Limited Company has several compliance requirements after incorporation. The company must:

• Appoint a statutory auditor within 30 days of incorporation.

• File income tax returns annually.

• Submit annual returns through forms like AOC-4 and MGT-7.

• File the ‘Commencement of Business’ declaration within 180 days.

• Ensure that the Directors Identification Number (DIN) is verified through the eKYC process each year. Failure to meet these compliances can result in penalties and fines.

4. How is a Private Limited Company registered in India?

The registration process of a Private Limited Company involves several steps:

• Obtain Digital Signature Certificate (DSC) for directors.

• Apply for a Director Identification Number (DIN) for the proposed directors.

• Reserve a unique company name with the MCA.

• Prepare the Memorandum of Association (MOA) and Articles of Association (AOA), which outline the company’s objectives and internal rules.

• File the SPICe+ (Simplified Proforma for Incorporating Company Electronically) form, which includes applications for PAN and TAN. Once all documents are approved by the Registrar of Companies (RoC), a Certificate of Incorporation is issued, and the company is legally established.

5. How many members are needed to start a Private Limited Company?

To form a Private Limited Company, a minimum of two members (shareholders) are required, and the maximum number of members allowed is 200. Each member contributes capital to the company and holds shares, which determine their ownership stake in the company.

6. How is ownership transferred in a Private Limited Company?

Ownership in a Private Limited Company is transferred through the transfer of shares. Shareholders can sell or transfer their shares to another person, thereby transferring ownership. This process requires a share transfer agreement and updating the company’s register of members. The transferee becomes the new shareholder once the process is complete.

7. What are the tax rates for Private Limited Companies?

Private Limited Companies in India are subject to a corporate tax rate of 30%, plus any applicable surcharge and cess. Additionally, companies may be subject to Minimum Alternate Tax (MAT), depending on their financial situation. Companies may also qualify for lower tax rates if they opt for certain concessional schemes, such as the reduced corporate tax rate of 22% under specific conditions.

8. Who regulates Private Limited Companies in India?

The Ministry of Corporate Affairs (MCA) and the Companies Act, 2013, govern the functioning and regulations of Private Limited Companies in India. The MCA monitors the compliance of companies, including filing of returns, maintaining statutory records, and ensuring adherence to corporate laws. The Registrar of Companies (RoC) under the MCA handles company registrations and compliance enforcement.

9. What are the benefits of registering a Private Limited Company?

There are several advantages to registering as a Private Limited Company:

• Limited Liability: Shareholders are only liable for the company’s debts up to the amount they have invested in shares, protecting personal assets.

• Access to Funding: Private Limited Companies can raise capital through equity funding, venture capital, or loans.

• Separate Legal Entity: The company is a distinct legal entity, separate from its owners, allowing for perpetual existence.

• Scalability: A Private Limited Company structure supports business growth and scalability, allowing you to add more shareholders.

• Tax Benefits: There are various tax advantages available to Private Limited Companies compared to other business structures.

• Professional Image: Being a registered company adds to the business's credibility and trustworthiness, attracting customers, investors, and lenders.

10. What minimum documents are required to incorporate a Private Ltd?

There are several advantages to registering as a Private Limited Company:

1. Passport-sized Photographs of the directors.

2. Identity Proof of Directors and Shareholders: PAN card for Indian nationals and passport for foreign nationals.

3. Address Proof: Aadhar card, voter ID, passport, or driving license.

4. Residential Proof: Recent utility bills or bank statements.

5. Registered Office Proof: Rent agreement and NOC from the landlord if rented, or ownership documents if owned. Get NOC letter from Free download section.

Additionally, you may visit www.startup2msme.in for other clarifications.

11. What documents are needed to open a current account for a Private Limited Company?

Once a Private Limited Company is incorporated, it is mandatory to open a current account in the company’s name for financial transactions. The required documents include:

• Certificate of Incorporation issued by the Registrar of Companies.

• Memorandum of Association (MOA) and Articles of Association (AOA).

• Board Resolution authorizing the opening of the bank account.

• Board Resolution authorizing the opening of the bank account.

• Utility bill (electricity, water, or telephone bill) for the registered office address.

• Identity proof of the authorized signatories, such as their PAN or Aadhar card. Your legal advisor can help guide you through the process of choosing the right bank and sub

Contact

KP SQUARE, 8th Floor, office no -: 806, 41/3, Telco Rd, Indira Nagar, Mohan Nagar, MIDC, Chinchwad, Pimpri-Chinchwad, Maharashtra 411019

Email Us

Pvt Ltd Incorporation

Pvt Ltd Incorporation

LLP Incorporation

LLP Incorporation

Trademark Registration

Trademark Registration

Udyam Registration

Udyam Registration

DSC-Digital Signature Certificate

DSC-Digital Signature Certificate

Startup India Registration

Startup India Registration

GST Registration

GST Registration

Preparation of MIS

Preparation of MIS

ESI Registration

ESI Registration