Import Export Code

Contact Us

Import Export Code (IEC) Registration: Your Gateway to Global Trade! 🌍

Import Export Code (IEC) is a unique 10-digit code issued by the Directorate General of Foreign Trade (DGFT) in India. This code is mandatory for anyone looking to engage in international trade—whether importing goods into India or exporting products to other countries. Securing your IEC is essential to legally conduct cross-border transactions and access various benefits associated with international trade.

At Startup2MSME, we simplify the IEC registration process, providing hassle-free online services tailored to your business needs. Whether you’re a budding entrepreneur or an established business looking to expand globally, our expert team is here to assist you every step of the way.

Contact us today to get started on your Import Export Code registration! 📞

What is Import Export Code (IEC)? 📝

The Import Export Code is a fundamental requirement for businesses engaged in international trade. It serves as a unique identification number that allows importers and exporters to conduct trade activities seamlessly. Without an IEC, businesses cannot import or export goods and are unable to avail themselves of benefits from government schemes aimed at promoting foreign trade.

Importance of IEC Registration 🎯

• Legal Requirement: IEC registration is mandatory for all businesses involved in international trade.

• Facilitates Trade: It simplifies the import and export process, making it easier to conduct transactions.

• Access to Benefits: Registered businesses can avail themselves of various government schemes and incentives for exporters.

• Banking Transactions: Banks require an IEC for facilitating foreign trade transactions.

• Custom Clearance: An IEC is necessary for smooth customs clearance and avoiding delays in shipments.

Who Needs to Obtain an IEC? 📌

• Importers: Any individual or business looking to import goods into India.

• Exporters: Businesses that intend to export goods or services from India.

• Startups and Established Businesses: Both new and existing companies seeking to enter or expand in global markets must have an IEC.

Required Documents for IEC Registration 📄

To complete your IEC registration, you will need the following documents:

• PAN Card: Permanent Account Number of the applicant or the business entity.

• Identity Proof: A government-issued ID of the applicant (Aadhar, Passport, Voter ID).

• Address Proof: Utility bills, rental agreements, or property documents for the business address.

• Bank Details: A canceled cheque or bank statement for the business account.

• Business Registration Document: Certificate of Incorporation, Partnership Deed, or any other relevant business registration document.

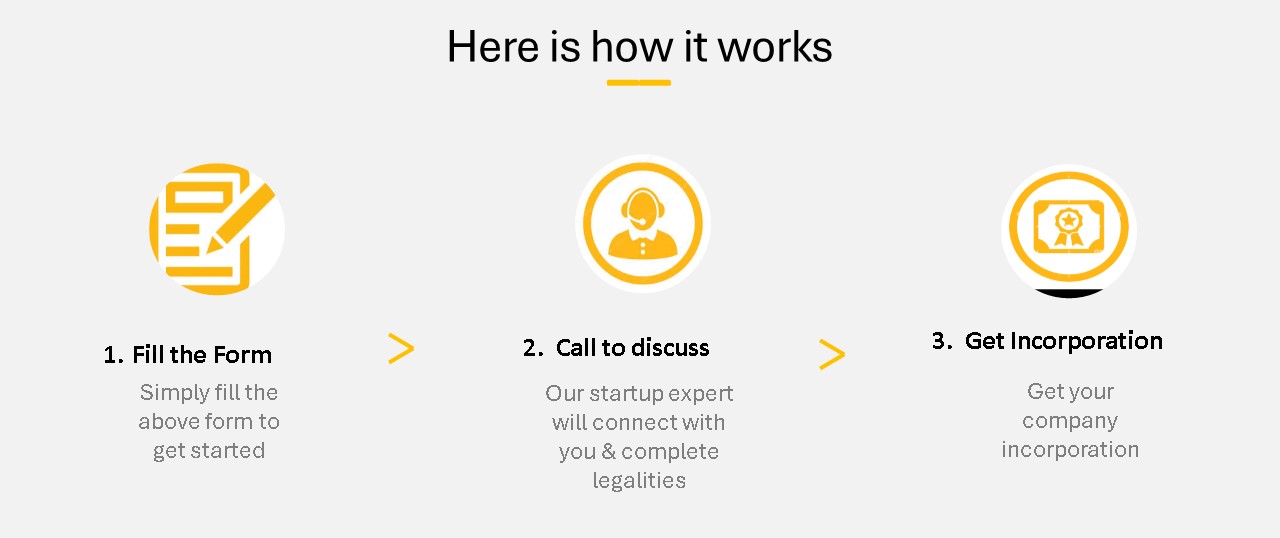

IEC Registration Process 🛠️

Follow these simple steps to register for an Import Export Code:

1. Visit the DGFT Website: Go to the official DGFT portal for IEC registration.

2. Create an Account: Register on the DGFT website to create your account.

3. Fill Out the Application Form: Complete the online application form with the necessary details about your business.

4. Upload Documents: Attach the required documents for verification.

5. Submit the Application: Review all the details and submit your IEC application.

6. Receive IEC Number: Upon successful verification, you will receive your Import Export Code, allowing you to engage in international trade.

How Can Startup2MSME Help? 💼

At Startup2MSME, we take the stress out of Import Export Code registration. Our dedicated team provides expert guidance, assists with document preparation, and ensures full compliance with DGFT requirements—all at competitive prices. We handle your application submission and keep you updated throughout the process. Whether you’re starting a new venture or expanding your business internationally, our services are designed to cater to your unique needs. With Startup2MSME, you can navigate the IEC registration process with confidence and focus on growing your global presence. Contact us today to kickstart your Import Export Code registration! ✨

Our Clients

Services

FAQ

1. What is an Importer-Exporter Code (IEC)?

An Importer-Exporter Code (IEC) is a key business identification number required for anyone engaging in import or export activities in India. Without an IEC, no individual or entity can export from or import to India, unless they are specifically exempted.

2. Why is the IEC important?

Importers must provide their IEC when clearing goods through customs in India. Similarly, exporters need to mention their IEC when shipping goods out of India. The Reserve Bank of India (RBI) also requires the IEC to be quoted for foreign remittances related to the import or export of services. Therefore, obtaining an IEC is essential for anyone involved in international trade.

3. Is there any tax associated with the IEC?

No, the IEC is not a tax registration, and no taxes are levied solely based on the IEC. However, customs duties or other applicable taxes may still apply during the import or export of goods or services.

4. Who needs to register for an IEC?

Any individual or entity intending to import or export goods or services to or from India must obtain an IEC.Yes, a Partnership firm can be converted into a Limited Liability Partnership (LLP) or a Company. However, the process involves several legal steps, including approvals from various regulatory bodies, and can be time-consuming. Entrepreneurs who expect growth and legal flexibility may find it easier to start directly with an LLP or Company rather than converting later.

5. How long does it take to get an IEC?

IEC registration is typically processed by the Directorate General of Foreign Trade (DGFT) within 10-15 working days after submitting the complete application and required documents.

6. What happens if I don't have an IEC?

IEC is not mandatory for everyone, but it is required for anyone importing or exporting goods or services. Without an IEC, you cannot engage in international trade, but there are no penalties for not having one if you are not engaged in such activities.

7. Do I need to file returns for an IEC?

No, there are no return-filing requirements associated with the IEC.

8. How long is the IEC valid?

The IEC is valid for the lifetime of the business or entity and does not need to be renewed.

9. Is an IEC required to import or export goods for personal use?

No, the IEC is only necessary for commercial imports or exports. Goods imported or exported for personal use do not require an IEC.

10. What documents are needed to register for an IEC?

To register for an IEC, you will need a copy of your PAN card, proof of the business address, documents related to the business structure (such as a partnership deed or incorporation certificate), and a letter from your banker.

Contact

KP SQUARE, 8th Floor, office no -: 806, 41/3, Telco Rd, Indira Nagar, Mohan Nagar, MIDC, Chinchwad, Pimpri-Chinchwad, Maharashtra 411019

Email Us

Pvt Ltd Incorporation

Pvt Ltd Incorporation

LLP Incorporation

LLP Incorporation

Trademark Registration

Trademark Registration

Udyam Registration

Udyam Registration

DSC-Digital Signature Certificate

DSC-Digital Signature Certificate

Startup India Registration

Startup India Registration

GST Registration

GST Registration

Preparation of MIS

Preparation of MIS

ESI Registration

ESI Registration