Trust Registration

Contact Us

Trust Registration: Secure Your Legacy and Make a Difference 🌟

Establishing a Trust is a powerful way to manage assets, support charitable causes, and ensure your legacy continues. Trust registration formalizes your intentions, providing legal recognition and ensuring that your assets are managed according to your wishes.

At Startup2MSME, we understand that the trust registration process can be complex and overwhelming. That’s why we offer a seamless, hassle-free online service for Trust registration, tailored to meet your specific needs at competitive prices. Whether you’re setting up a charitable trust or a family trust, our expert team is here to guide you every step of the way.

Contact us today to embark on your Trust registration journey! 📞

What is a Trust? 🤝

A Trust is a fiduciary arrangement that allows a third party (the trustee) to hold assets on behalf of beneficiaries. Trusts can be used for various purposes, including managing family wealth, supporting charitable activities, or ensuring proper asset distribution according to your wishes.

Legal Framework for Trust Registration 📜

In India, trusts are governed by the Indian Trusts Act, 1882. This legislation outlines the rights and responsibilities of trustees, beneficiaries, and the procedures for creating and registering a trust.

Benefits of Trust Registration 🌟

• Legal Recognition: Registered trusts have legal standing, allowing them to own property and enter contracts.

• Asset Protection: Trusts safeguard assets from creditors and ensure that they are used according to the trust's objectives.

• Tax Benefits: Registered trusts may be eligible for certain tax exemptions, especially charitable trusts.

• Management of Assets: Trusts provide a structured way to manage and distribute assets, ensuring your wishes are honored.

• Continuity: Trusts can continue to operate regardless of changes in personal circumstances, such as death or incapacity.

Types of Trusts You Can Register 🔍

• Private Trust: Created for the benefit of specific individuals, such as family members.

• Public Trust: Established for charitable purposes and benefits the general public or a specific community.

• Revocable Trust: Can be modified or revoked by the settlor during their lifetime.

• Irrevocable Trust: Once established, it cannot be altered or dissolved without the beneficiaries' consent.

Who Can Be a Partner? 👥Documents Required for Trust Registration 📄

In India, partnership firms are governed by the Indian Partnership Act of 1932. Partners are those who unite to form a partnership, and their agreement is documented in a partnership deed.

Legal Framework for Partnership Firms 📜

To register your Trust, you will need the following documents:

• Trust Deed: A legal document outlining the trust's objectives, beneficiaries, and trustee responsibilities.

• Identity Proof: PAN card, Aadhar card, or passport of all trustees and beneficiaries.

• Address Proof: Utility bills, bank statements, or property documents for the registered office.

• Photographs: Recent passport-sized photographs of the trustees.

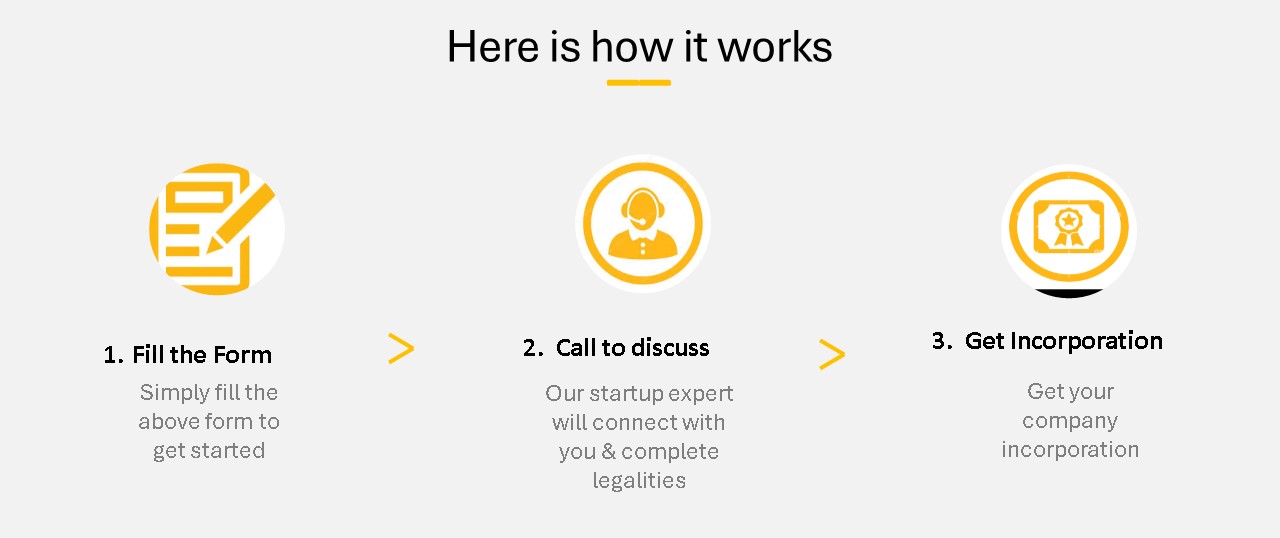

Trust Registration Process 🛠️

Here’s a step-by-step guide to registering your Trust:

1. Draft the Trust Deed: Prepare a comprehensive Trust Deed detailing the purpose, trustees, and beneficiaries of the trust.

2. Choose Trustees: Select trustworthy individuals who will manage the trust's assets and execute its objectives.

3. Application for Registration: Submit the Trust Deed along with the required documents to the relevant authorities (usually the local registrar).

4. Payment of Fees: Pay the registration fees, which may vary based on the trust's nature and location.

5. Obtain Registration Certificate: Once verified, you will receive a Registration Certificate, confirming the establishment of your Trust.

How Can Startup2MSME Help? 💼

We simplify the Trust registration process for you! Our dedicated team at Startup2MSME provides expert guidance, assists in document preparation, and ensures full compliance with all legal requirements—all at competitive fees. We handle your application submission and keep you informed throughout the process. Whether you’re starting a new trust or formalizing an existing one, our services are tailored to meet your unique needs. Our support extends beyond registration; we also help you understand your ongoing responsibilities as a trust owner. With Startup2MSME, you can confidently navigate the Trust registration process, allowing you to focus on fulfilling your vision. Our effective solutions and affordable fees make the entire process hassle-free. Contact us today to take the first step toward establishing your Trust! ✨

Our Clients

Services

FAQ

1. What is a Trust?

A trust is a legal arrangement where one party, known as the trustee, holds and manages assets or property for the benefit of another party, known as the beneficiary. Trusts can be established for various purposes, including charitable, religious, or educational activities.

2. What is the Mumbai Public Trust Act?

The Mumbai Public Trust Act, 1950, governs the registration and regulation of public trusts in Maharashtra, including Mumbai. It provides the legal framework for the establishment and management of public trusts.

3. Who can establish a Trust?

Any individual or group of individuals can establish a trust. However, the trust must be created for a lawful purpose, which can be charitable, religious, or any other purpose that benefits the public or a section of the public.

4. What are the types of trusts recognized under the Mumbai Public Trust Act?

The Act recognizes two main types of trusts:

• Public Trusts: Created for the benefit of the general public or a specific community.

• Private Trusts: Created for the benefit of specific individuals or families (not covered under this act).

5. What documents are required for Trust Registration?

The following documents are typically required:

• Trust Deed (duly signed by the settlor and trustees)

• PAN card of the trust and its trustees

• Address proof of the trust and its trustees.

• NOC from the landlord (if the trust is established in a rented premises)

• Registration certificate (if applicable)

• Financial statements (if available)

6. How to register a Trust under the Mumbai Public Trust Act?

The process involves:

• Drafting the Trust Deed, clearly outlining the objectives, name, and details of the trustees.

• Submitting the Trust Deed and required documents to the local Assistant Charity Commissioner’s office.

• Filling out the registration application form and paying the applicable fees.

• Once submitted, the application will be reviewed, and if everything is in order, the trust will be registered.

7. What is the fee for Trust Registration?

The registration fee varies based on the type of trust and its objectives. It's advisable to check with the local Charity Commissioner’s office for the exact fee structure.

8. Is it mandatory to register a Trust?

Yes, if a trust is intended to operate as a public trust in Maharashtra, it must be registered under the Mumbai Public Trust Act to gain legal recognition and benefit from the privileges associated with registration.

9. What are the advantages of registering a Trust?

• Legal recognition of the trust.

• Eligibility for tax exemptions under Section 12A and 80G of the Income Tax Act.

• Enhanced credibility with donors and stakeholders.

• Access to government grants and assistance for registered trusts.

10. Can a Trust be modified or dissolved after registration?

Yes, a trust can be modified or dissolved according to the terms outlined in the Trust Deed. However, any changes must comply with the provisions of the Mumbai Public Trust Act and may require approval from the Charity Commissioner.

11. What is the role of the Charity Commissioner?

The Charity Commissioner oversees the registration, regulation, and management of public trusts in Maharashtra. They ensure compliance with the Mumbai Public Trust Act and address grievances related to public trusts.

12. How can one find details about existing Trusts in Mumbai?

Information about registered trusts can be accessed through the office of the Assistant Charity Commissioner or their official website, where details of registered public trusts are maintained.

13. Are there any compliance requirements after Trust Registration?

Yes, registered trusts must comply with various requirements, including:

• Filing annual returns and financial statements.

• Maintaining proper records of accounts and activities.

• Ensuring compliance with the objectives stated in the Trust Deed.

14. What happens if a Trust fails to comply with regulations?

Non-compliance with the regulations can lead to penalties, cancellation of registration, and legal action by the Charity Commissioner. It is essential for trustees to understand and fulfill their obligations.

Contact

KP SQUARE, 8th Floor, office no -: 806, 41/3, Telco Rd, Indira Nagar, Mohan Nagar, MIDC, Chinchwad, Pimpri-Chinchwad, Maharashtra 411019

Email Us

Pvt Ltd Incorporation

Pvt Ltd Incorporation

LLP Incorporation

LLP Incorporation

Trademark Registration

Trademark Registration

Udyam Registration

Udyam Registration

DSC-Digital Signature Certificate

DSC-Digital Signature Certificate

Startup India Registration

Startup India Registration

GST Registration

GST Registration

Preparation of MIS

Preparation of MIS

ESI Registration

ESI Registration