Partnership

Contact Us

Partnership Firm Registration: Your Gateway to Success 🌟

A partnership is a formal arrangement by two or more parties to manage and operate a business and share its profits.

A partnership firm is a popular choice for entrepreneurs because it’s simple and flexible. It allows multiple individuals to pool their resources, skills, and expertise to run a business effectively. Registering your partnership firm is the first crucial step toward formalizing your partnership and ensuring it is legally recognized.

At Startup2MSME, we know that navigating the registration process can be overwhelming. That’s why we offer a seamless and hassle-free online service for partnership firm registration, tailored to fit your needs with affordable fees. Whether you’re a fresh startup or an existing unregistered partnership wanting to formalize your operations, our expert team is here to guide you through every step.

Get in touch with us now to kickstart your partnership firm registration journey! 📞

What is a Partnership Firm? 🤝

A partnership is a foundational structure for conducting business. It occurs when two or more individuals join forces to create a business venture, sharing profits based on a mutual agreement. This business model encompasses a wide range of trades, professions, and occupations. One significant benefit is that partnership firms come with fewer regulatory hurdles than companies

Legal Framework for Partnership Firms 📜

In India, partnership firms are governed by the Indian Partnership Act of 1932. Partners are those who unite to form a partnership, and their agreement is documented in a partnership deed.

What is a Partnership Deed? ✍️

A partnership deed is a legal document that specifies the terms and conditions of the partnership. It outlines partners’ rights and duties, profit-sharing ratios, capital contributions, and the duration of the partnership.

This document is crucial as it helps prevent misunderstandings among partners by clearly defining their roles. It also serves as proof of the partnership’s existence and can be used in legal disputes.

Partnership Firm Registration 🏢

Registering a partnership firm involves officially registering it with the Registrar of Firms in the state where the firm operates. While registration is optional, it offers numerous advantages. Partners can choose to register the partnership deed during the firm’s formation or at a later stage.

To register the partnership deed, two or more individuals must come together, agree on a firm name, and create the deed.

Who Can Be a Partner? 👥

In India, partnership firms are governed by the Indian Partnership Act of 1932. Partners are those who unite to form a partnership, and their agreement is documented in a partnership deed.

Legal Framework for Partnership Firms 📜

To join a partnership firm in India, individuals must meet the following criteria:

• Mental and Legal Fitness: Partners must be mentally sound, of legal age, not insolvent, and not prohibited from making contracts.

• Registered Partnerships: Registered firms can partner with other businesses.

• Hindu Family Heads: Heads of Hindu Undivided Families (HUF) can become partners if they contribute their skills and labor.

• Companies as Partners: Legal entities like companies can also be partners if permitted by their objectives.

• Trustees of Specific Trusts: Trustees of private religious, family, or Hindu trusts can join as partners unless restricted by their trust rules.

Advantages of a Partnership Firm 🌈

• Ease of Formation: Simple and cost-effective to set up, with fewer formalities than other business structures.

• Diverse Skills: Partners bring varied skills and resources, enhancing the business's capabilities.

• Shared Financial Responsibility: Financial risks are shared, making them easier to manage.

• Tax Benefits: Partnerships are not taxed as entities; profits are taxed at individual partners' rates, potentially leading to tax savings.

• Flexible Decision-Making: Partners can have a say in operations and decisions.

• Greater Access to Capital: Partners can contribute capital, and more partners can be added to raise funds.

Disadvantages of a Partnership Firm ⚠️

While partnership firms can be beneficial, they come with some drawbacks:

• Unlimited Liability: Partners have personal liability for the firm’s debts, risking their personal assets.

• Limited Capital: Raising large amounts of capital may be difficult, relying on partners’ contributions.

• Conflict Potential: Differences among partners can lead to conflicts and slow decision-making.

• Limited Growth Potential: Partnerships may struggle with growth compared to larger structures.

• Continuity Issues: A partner’s death, withdrawal, or insolvency can disrupt the firm unless the partnership deed has provisions for continuity.

• Tax Complexity: Each partner handles their own tax compliance, which can get complicated.

Why Register Your Partnership Firm? 📝

Although not mandatory under the Indian Partnership Act, registering your partnership firm is wise for several reasons:

• Legal Recognition: Registered firms have legal standing, allowing them to enforce rights against partners and third parties.

• Ability to Sue: Registered firms can initiate legal actions against third parties to protect their contractual rights.

• Claiming Set-Off: Registered firms can claim legal remedies that unregistered firms cannot.

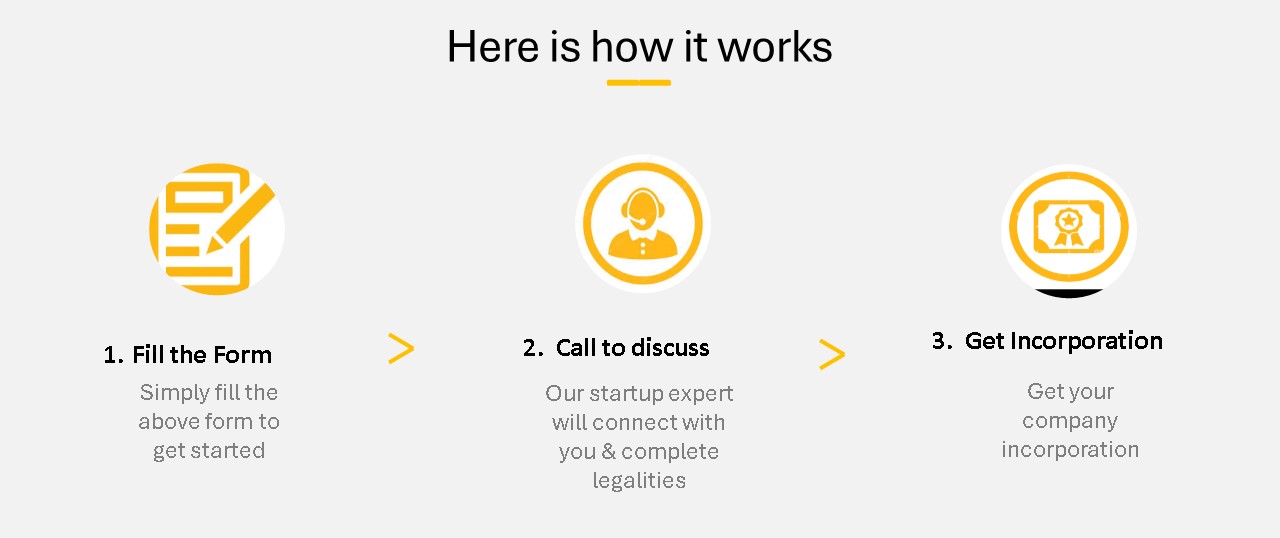

Partnership Firm Registration Process 🚀

Here’s how to register your partnership deed:

1. Obtain a Digital Signature Certificate (DSC): All partners need a DSC for online signing, which can be obtained from certified agencies.

2. Apply for a Designated Partner Identification Number (DPIN): After securing a DSC, partners must apply for a unique DPIN via the MCA website.

3. Choose a Firm Name: Select a unique name that complies with legal naming regulations and is not similar to any existing firm.

4. Draft the Partnership Deed: Create a comprehensive deed detailing terms, including the firm name, partner names, business nature, profit-sharing ratio, and duration.

5. Apply for Registration: Submit the application to the Registrar of Firms with details like the firm’s name, principal place of business, and partners' information.

6. Obtain the Certificate of Registration: Upon verification, the Registrar will issue a Certificate of Registration, confirming the partnership’s legal status.

7. Apply for PAN and TAN: Finally, apply for a Permanent Account Number (PAN) and a Tax Deduction and Collection Account Number (TAN) from the Income Tax Department.

How Can Startup2MSME Help? 💼

We simplify partnership firm registration for you! Our experienced team at Startup2MSME offers expert guidance, document preparation, name selection assistance, and ensures compliance with all legal requirements—all at affordable fees. We handle your application submission and keep you updated throughout the process. Whether you're starting a new partnership or formalizing an existing one, our services are tailored to your unique needs. Our support doesn’t stop at registration; we help you understand the ongoing responsibilities of operating a registered partnership firm. With Startup2MSME, you can confidently navigate the registration process, allowing you to focus on growing your business. Our efficient solutions and reasonable fees make everything hassle-free. Contact us today to embark on your journey to a successful partnership! ✨

Our Clients

Services

FAQ

1. Is it mandatory to register a Partnership firm in India?

No, it is not legally required to register a Partnership firm in India. However, registering the firm under the Indian Partnership Act, 1932 is highly recommended as it grants the firm certain legal rights, such as the ability to file lawsuits in court. Unregistered firms cannot enforce their rights in legal disputes or claim set-offs in lawsuits.

2. How many partners are required to start a Partnership firm?

A minimum of two partners is required to form a Partnership firm, and the maximum number allowed is 20 partners. This range allows flexibility in structuring the firm according to its size and nature of operations.

3. What is a Partnership deed, and why is it important?

A Partnership deed is a legal document that outlines the terms, conditions, and responsibilities of the partners in a firm. It is essential because it defines the roles, profit-sharing ratios, decision-making processes, and other crucial aspects. Having a well-drafted deed helps prevent disputes by clearly stating the rights and obligations of each partner.

4. Can a Partnership firm be converted into a Company or LLP?

Yes, a Partnership firm can be converted into a Limited Liability Partnership (LLP) or a Company. However, the process involves several legal steps, including approvals from various regulatory bodies, and can be time-consuming. Entrepreneurs who expect growth and legal flexibility may find it easier to start directly with an LLP or Company rather than converting later.

5. What are the benefits of registering a Partnership firm?

Registering a Partnership firm offers multiple legal benefits. A registered firm can:

• File lawsuits against other parties, including its partners.

• Protect its rights and claim set-offs in case of legal disputes.

• Ensure that all partners are bound by the agreed terms under legal scrutiny. These legal protections provide more security and trust in business operations.

6. What documents are required to register a Partnership firm?

To register a Partnership firm, the following documents are typically required:

1.PAN cards of all partners.

2.Proof of identity (such as an Aadhar card, driving license, or passport).

3.Proof of address (such as utility bills or a rental agreement).

4.NOC from Landlord (if rented property). NOC is attached in the free download section.

5.A Partnership deed, signed by all partners, detailing the terms of the partnership. This set of documents is submitted to the Registrar of Firms to complete the registration process

Additionally, you may visit www.startup2msme.in for other clarification

7. Who can become a partner in a Partnership firm?

Any Indian citizen residing in India can become a partner in a Partnership firm. In addition, non-resident Indians (NRIs) or persons of Indian origin (PIOs) can also invest in a Partnership firm, but only with prior government approval. Legal entities like companies and registered firms can also become partners if their objectives allow it.

8. Is an audit required for a Partnership firm?

While it is not mandatory for Partnership firms to undergo an annual audit of their financial statements, a tax audit may be required if the firm meets certain financial criteria. For instance, if the firm’s turnover exceeds a specific threshold, a tax audit is compulsory to ensure compliance with tax regulations.

9. Can a partner transfer their share in the Partnership firm?

No, a partner cannot transfer their ownership share in the Partnership firm to an external party without the prior consent of all other partners. This rule is designed to maintain control over the firm’s management and avoid unwanted partners.

10. How can a Partnership firm open a bank account?

To open a bank account in the name of a Partnership firm, the firm must provide:

• A registered Partnership deed.

• Identity and address proof of the partners.

• A firm registration certificate, if applicable. Most banks will require these documents to verify the legitimacy of the Partnership and the authority of the partners to operate the account.

Contact

KP SQUARE, 8th Floor, office no -: 806, 41/3, Telco Rd, Indira Nagar, Mohan Nagar, MIDC, Chinchwad, Pimpri-Chinchwad, Maharashtra 411019

Email Us

Pvt Ltd Incorporation

Pvt Ltd Incorporation

LLP Incorporation

LLP Incorporation

Trademark Registration

Trademark Registration

Udyam Registration

Udyam Registration

DSC-Digital Signature Certificate

DSC-Digital Signature Certificate

Startup India Registration

Startup India Registration

GST Registration

GST Registration

Preparation of MIS

Preparation of MIS

ESI Registration

ESI Registration