ESI Registration

Contact Us

ESI Registration: Safeguarding Your Workforce! 🏥

ESI Registration, or Employee State Insurance Registration, is a crucial process for businesses in India that ensures social security and health insurance benefits for employees. It provides financial support in times of need, such as sickness, maternity, and injury.

At Startup2MSME, we streamline the ESI registration process, making it easy for you to protect your employees!

Contact us today to get started on your ESI registration journey! 🌟

What is ESI Registration? 📋

ESI Registration is the enrollment of businesses under the Employee State Insurance Corporation (ESIC) scheme. It allows eligible employees to access various health and social security benefits funded by contributions from both employers and employees.

Importance of ESI Registration 🌈

• Health Benefits: Registered employees receive medical care and treatment for themselves and their families.

• Sickness Benefits: Employees are entitled to a percentage of their salary during medical leave.

• Maternity Benefits: Support is provided to female employees during pregnancy and childbirth.

• Employment Injury Benefits: Compensation for employees who face injury or disability while on the job.

Who Needs to Register for ESI? 👥

• Businesses with 10 or More Employees: Any establishment with 10 or more employees (20 in some cases) is required to register for ESI if employees earn up to ₹21,000 per month (₹25,000 for disabled individuals).

Documents Required for ESI Registration 📑

To register for ESI, you will need the following documents:

• Business Registration Proof: Certificate of incorporation or partnership deed.

• PAN Card: Permanent Account Number of the organization.

• Address Proof: Utility bill or rental agreement for the business premises.

• Employee Details: A list of employees along with their salaries.

• Bank Account Details: The organization's bank account information.

Documents Required for ITR Filing 📑

To file your ITR, gather the following documents:

• Form 16: Salary certificate provided by your employer.

• Form 26AS: Tax credit statement showing taxes deducted.

• Bank Statements: For interest income and other financial details.

• Investment Proof: Receipts for investments eligible for deductions (like ELSS, PPF, etc.).

• PAN Card: Permanent Account Number for identification.

• Aadhar Card: For verification purposes.

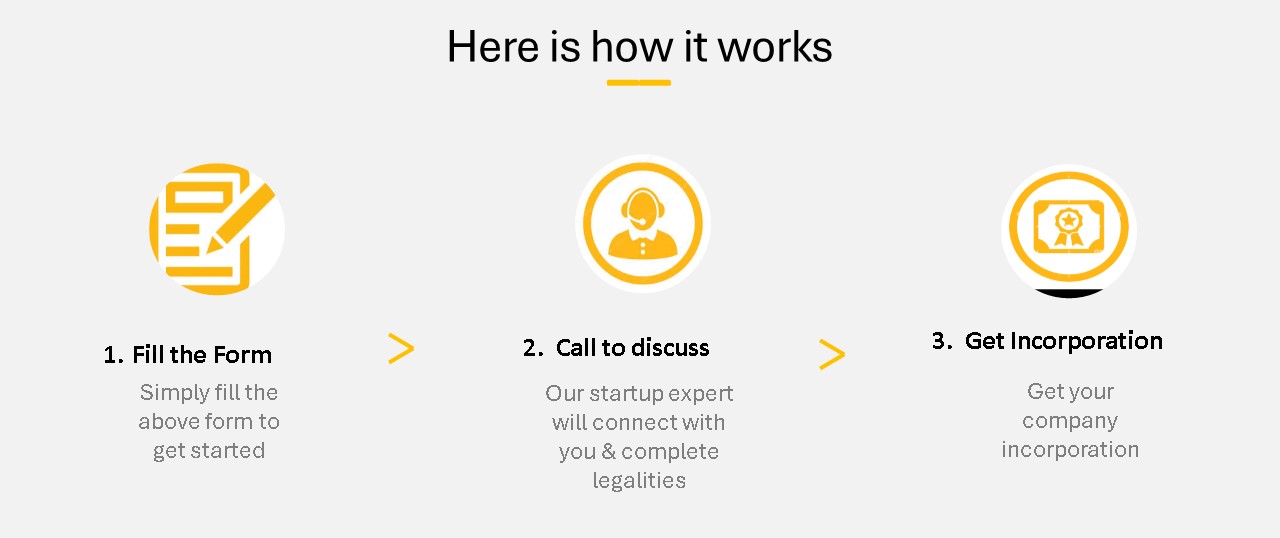

Process of ESI Registration 🔍

Here’s a step-by-step guide to registering for ESI:

1. Gather Required Documents: Collect all necessary documents mentioned above.

2. Visit the ESIC Website: Go to the official ESIC website to begin the registration process.

3. Complete the Application Form: Fill out the online application form with all required information.

4. Upload Documents: Attach the necessary documents to the application.

5. Submit the Application: Review and submit the application for registration.

6. Receive Registration Certificate: After verification, you will receive an ESI registration number and certificate.

Benefits of ESI Registration for Employers 🌟

• Legal Compliance: ESI registration ensures your business complies with labor laws, avoiding penalties.

• Enhanced Employee Welfare: Providing ESI benefits fosters a supportive work environment, boosting morale.

• Attracting Talent: Employees value health and social security benefits, making your business more attractive to potential hires.

How Can Startup2MSME Help You? 🤝

At Startup2MSME, we make ESI registration hassle-free:

• Expert Guidance: Our experienced team will assist you in understanding the requirements and benefits of ESI registration.

• Document Preparation: We help you prepare and organize all necessary documentation for smooth registration.

• Timely Filing: Ensure your registration is completed on time to avoid delays or penalties.

• Post-Registration Support: We provide ongoing assistance to help you navigate ESI compliance and contributions.

With Startup2MSME, you can ensure your ESI registration is handled efficiently, allowing you to focus on your business growth.

Contact us today to safeguard your workforce with ESI registration! 📞

Our Clients

Services

FAQ

1. What is ESI Registration?

ESI Registration is a compulsory procedure for Indian businesses to enroll in the Employee State Insurance Corporation (ESIC) scheme. This program offers social security and health insurance benefits to employees earning within a specified limit.

2. Who needs to register for ESI?

Any business, such as factories, shops, or establishments, that has 10 or more employees (or 20 in certain cases) and where employees earn up to ₹21,000 per month (₹25,000 for those with disabilities) must complete ESI registration.

3. How can startup2msme assist with ESI Registration?

Startup2msme provides expert guidance to help businesses navigate the intricacies of the ESI registration process online, ensuring a smooth and efficient experience.

4. What are the advantages of ESI registration for employees?

Employees registered under the scheme can benefit from various services, including maternity and sickness benefits, medical treatment for family members, and compensation in the event of work-related injuries or fatalities.

5. What documents are necessary for ESI registration?

Essential documents for ESI registration typically include proof of business registration, GST certificate, Memorandum and Articles of Association (MoA and AoA) for companies, address proof, PAN cards for the business and employees, and a list of all employees along with their salary details.

6. How has the ESI registration process evolved?

The ESI registration procedure has shifted from a manual system to a fully online platform, enhancing accessibility and efficiency for businesses.

7. What compliance obligations exist after ESI registration?

Once registered, businesses must maintain various records (such as wages and attendance), submit monthly returns and challans, and keep an accident register, among other responsibilities.

8. What role does startup2msme play after ESI registration?

In addition to helping with registration, startup2msme assists businesses in adhering to ESIC regulations and ensuring timely submission of required documents and returns.

9. How long does the ESI registration process take when using startup2msme?

While the exact timeline may differ, startup2msme aims to expedite the registration process, often completing it within a few days after receiving all necessary documentation.

10. Are there penalties for not complying with ESI regulations?

Yes, businesses that fail to comply with ESI regulations may incur penalties, including fines and potential legal consequences. Startup2Msmes can help prevent these issues by ensuring compliance.

Contact

KP SQUARE, 8th Floor, office no -: 806, 41/3, Telco Rd, Indira Nagar, Mohan Nagar, MIDC, Chinchwad, Pimpri-Chinchwad, Maharashtra 411019

Email Us

Pvt Ltd Incorporation

Pvt Ltd Incorporation

LLP Incorporation

LLP Incorporation

Trademark Registration

Trademark Registration

Udyam Registration

Udyam Registration

DSC-Digital Signature Certificate

DSC-Digital Signature Certificate

Startup India Registration

Startup India Registration

GST Registration

GST Registration

Preparation of MIS

Preparation of MIS

ESI Registration

ESI Registration