Professional Tax

Contact Us

Professional Tax Registration: Stay Compliant with State Laws! 💼

Professional Tax Registration is essential for businesses and individuals earning income in India. Imposed by state governments, this tax applies to professions, trades, and employment, ensuring that the revenue generated supports local development. By registering for professional tax, businesses can ensure compliance and avoid penalties.

At Startup2MSME, we streamline the professional tax registration process, providing easy online services customized to your needs. Whether you’re a new business or an existing entity looking to comply with state regulations, our expert team is here to guide you every step of the way.

Contact us today to kickstart your Professional Tax Registration journey! 📞

What is Professional Tax? 📝

Professional Tax is a tax levied by state governments on individuals and entities earning an income through professions, trades, or employment. The amount of tax varies from state to state, and it is deducted from salaries or business earnings, contributing to the state’s revenue.

Importance of Professional Tax Registration 🎯

• Legal Compliance: Professional tax registration is mandatory for businesses and individuals, ensuring adherence to state laws.

• Avoid Penalties: Timely registration and payment help avoid fines and legal issues.

• Enhances Credibility: Compliance boosts your business's reputation and demonstrates responsibility.

• Facilitates Deductions: Registered businesses can deduct professional tax from employee salaries, simplifying tax management.

• Access to Government Services: Compliance enables access to various government services and benefits.

Who Needs to Register for Professional Tax? 📌

• Employers: All employers who have employees on their payroll must register for professional tax.

• Self-Employed Individuals: Freelancers, consultants, and self-employed professionals earning income must also register.

• Partnership Firms and Companies: All business entities earning income are required to obtain professional tax registration.

Required Documents for Professional Tax Registration 📄

To complete your professional tax registration, you will need the following documents:

• Proof of Business Existence: Certificate of Incorporation, partnership deed, or business registration certificate.

• Identity Proof: PAN card of the business owner or partners.

• Address Proof: Utility bills, rent agreements, or property documents to verify the business address.

• Employee Details: List of employees with their salary details if applicable.

• Bank Account Details: Details of the business's bank account for tax payment.

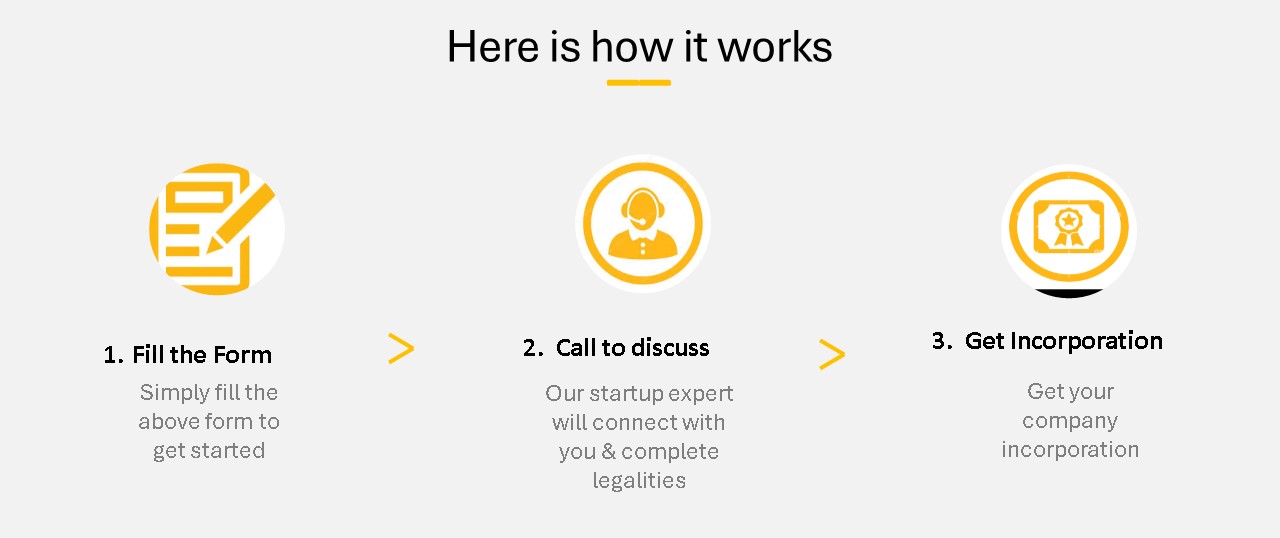

Professional Tax Registration Process 🛠️

Follow these simple steps to register for professional tax:

1. Visit the State Tax Department Website: Access the official website of your state’s tax department.

2. Fill Out the Application Form: Complete the online application form with details about your business and income.

3. Upload Documents: Attach the necessary documents for verification.

4. Submit the Application: Review all the information and submit your professional tax registration application.

5. Receive Registration Certificate: Upon successful verification, you will receive your professional tax registration certificate, confirming your compliance with state regulations.

How Can Startup2MSME Help? 💼

At Startup2MSME, we simplify Professional Tax Registration, making the process hassle-free! Our expert team provides personalized guidance, helps with document preparation, and ensures full compliance with state requirements—all at competitive prices. We take care of your application submission and keep you informed throughout the process. Whether you’re a new business or an existing entity seeking compliance, our services are tailored to your unique needs. With Startup2MSME, you can confidently navigate the professional tax registration process and secure your place in the business landscape. Contact us today to start your Professional Tax Registration! ✨

Our Clients

Services

FAQ

1. What is Professional Tax and When is it Levied?

Professional tax is a state-level tax levied on income earned through professions, trades, callings, or employment. It is calculated based on income slabs, applicable to both self-employed individuals and employees. The maximum tax amount currently capped is Rs. 2,500.

2. What are Enrolment and Registration Certificates?

In certain states, employers are required to deduct professional tax from employees' salaries if the payment exceeds Rs. 5,000 (for Maharashtra). Employers must then deposit the tax with the state government and obtain a registration certificate. If an individual is employed by multiple employers and earns more than Rs. 5,000, but their employer does not deduct professional tax, the individual must obtain an enrolment certificate from the relevant authority.

3. Is Professional Tax Imposed in Every Indian State?

No, professional tax is imposed only in specific states, including Karnataka, Bihar, West Bengal, Andhra Pradesh, Telangana, Maharashtra, Tamil Nadu, Gujarat, Assam, Kerala, Meghalaya, Odisha, Tripura, Madhya Pradesh, and Sikkim.

4. Can Professional Tax Be Paid in Lump Sum?

In some states, there is an option for a composition scheme. For example, in Maharashtra, a person liable to pay Rs. 2,500 annually can make an advance lump sum payment of Rs. 10,000 to cover five years of professional tax liability.

5. Who is Responsible for Deducting and Depositing Professional Tax?

• For self-employed individuals, the individual is responsible for paying the tax.

• For employed individuals, the employer is responsible for deducting and remitting the tax to the government.

6. Can Professional Tax Be Paid in Lump Sum?

In some states, there is an option for a composition scheme. For example, in Maharashtra, a person liable to pay Rs. 2,500 annually can make an advance lump sum payment of Rs. 10,000 to cover five years of professional tax liability.

7. What are the Costs Involved in the Registration Process?

The plan price includes all professional fees and convenience charges. Since professional tax is a state-level tax, the applicable government charges vary by state and are charged on an actual basis.

8. Are There Any Exemptions from Professional Tax?

Each state has its own exemption rules. For example, under Maharashtra’s Professional Tax Act, the following individuals are exempt from paying the tax:

• Charitable and philanthropic hospitals or nursing homes located in areas below the Taluk level, except in Maharashtra and Maharashtra Rural District.

• Directors of companies nominated by state government-controlled financing agencies.

• Foreign technicians approved by the Government of India, exempt for two years from the date of appointment.

• Combatant and non-combatant members of the Armed Forces governed by the Army, Navy, or Air Force Act.

• Blind or deaf and mute salaried or wage-earning individuals.

• Holders of permits for single taxis or single three-wheeler goods vehicles.

• Instructors teaching Kannada or English shorthand or typewriting.

• Persons with at least 40% permanent disability (with certification from a government civil hospital).

• Ex-servicemen not listed in item No.1 of the Schedule.

• Individuals with a single child who have undergone sterilization surgery (with a certificate from a government civil hospital).

• Central Para Military Force (CPMF) personnel.

• Persons running educational institutions up to 12th grade or pre-university level.

• Persons aged 65 or older, and those engaged in a profession for less than 120 days in a year.

9. Can a partner transfer their share in the Partnership firm?

No, a partner cannot transfer their ownership share in the Partnership firm to an external party without the prior consent of all other partners. This rule is designed to maintain control over the firm’s management and avoid unwanted partners.

10. How can a Partnership firm open a bank account?

To open a bank account in the name of a Partnership firm, the firm must provide:

• A registered Partnership deed.

• Identity and address proof of the partners.

• A firm registration certificate, if applicable. Most banks will require these documents to verify the legitimacy of the Partnership and the authority of the partners to operate the account.

Contact

KP SQUARE, 8th Floor, office no -: 806, 41/3, Telco Rd, Indira Nagar, Mohan Nagar, MIDC, Chinchwad, Pimpri-Chinchwad, Maharashtra 411019

Email Us

Pvt Ltd Incorporation

Pvt Ltd Incorporation

LLP Incorporation

LLP Incorporation

Trademark Registration

Trademark Registration

Udyam Registration

Udyam Registration

DSC-Digital Signature Certificate

DSC-Digital Signature Certificate

Startup India Registration

Startup India Registration

GST Registration

GST Registration

Preparation of MIS

Preparation of MIS

ESI Registration

ESI Registration